In their eagerness to simply get a job as a financial advisor, many new financial planners gloss over the details of what they’re agreeing to in their RIA employment agreement regarding their clients if it doesn’t work out. After all, it’s often a moot point to worry about what happens to your clients if the job doesn’t work out, as usually if it doesn’t work it’s because the new advisor struggled to get any clients in the first place. Except sometimes, it does matter, because sometimes it does work out, just not at an advisor’s current firm. Yet if you don’t want to stay with your current firm, you have to figure out what happens to your clients you have a relationship with when you leave the firm, and whether you are allowed to “take” them with you!

In this week’s #OfficeHours with @MichaelKitces, my Tuesday 1PM EST broadcast via Periscope, we discuss the dynamics of non-compete, non-solicit, and non-accept agreements for financial advisors working for an RIA, including how easy/difficult they are to enforce, and whether non-compete and non-solicit provisions are really “fair” in the first place.

Unfortunately, disputes over non-compete and non-solicit agreements are increasingly common issues to deal with when an advisor is leaving an RIA, as employment agreements themselves have become far more common as independent RIAs have grown larger. Yet even amongst the restrictive covenants in an employment agreement, there’s a big difference between non-compete, non-solicit, or non-accept provisions… both because some are far more restrictive than others, and also because not all of these are equally enforceable (at least in some states).

The first type of restrictive covenant in an employment agreement is a “Non-Compete”. A non-compete provision stipulates that if you leave the advisory firm, you can’t continue being a financial advisor for another firm – or your own firm – if it competes with your prior firm. In other words, if you leave, you can’t be a financial advisor anymore. Fortunately, in practice comprehensive non-competes like this are typically difficult to enforce, and in many states, they’re outright unenforceable. That being said, though, some states will allow narrower non-compete agreements, such as limiting you from being a financial advisor for another firm within 20 miles of your current firm. Although unfortunately, even though not all non-competes are enforceable, it hasn’t stopped a lot of RIAs from putting non-competes into their employment agreements, because not all advisors realize that the non-compete might be unenforceable in their state, and a lot of advisors don’t have the financial wherewithal to fight the non-compete and prove their case. So the firm gets away with it.

Because of the challenges with enforcing a Non-Compete, though, many RIAs that truly want to protect their client relationships, with something that can actually be enforced, require employee advisors to sign a Non-Solicit instead. A non-solicit agreement stipulates that you will not solicit any of the clients of the firm. In other words, you can’t contact any of the clients of your former firm to ask you to do business with you after you leave. Even if they were “your” clients. The key difference between a non-solicit and a non-compete is that with a non-solicit, you can continue to be a financial advisor. And you can be an advisor in the same industry, in the same niche, and even in the same geographic region. And because a non-solicit is narrower in scope, they’re much more likely to be enforced if challenged. Notably, a non-solicit doesn’t mean you can’t still work with your former clients, it means you can’t solicit them. So you can’t reach out to them after you leave and ask them to keep working with you, but you may be able to work with them if they follow you on their follow.

The third kind of agreement that exists in some RIA employment agreements is what’s called a “Non-Accept”. A non-accept agreement is basically an extended version of a non-solicit. The non-solicit says “here are a list of clients you can’t solicit.” A non-accept says “here are a list of clients you’re not allowed to accept, even if they contact you unsolicited.” In practice, these are less common in the RIA business, as similar to broad-reaching non-compete agreements, they aren’t always able to be enforced in a court if challenged. Still, though, it’s a matter that varies by state. And some RIAs include a non-accept provision in their non-solicit agreement, simply on the hopes that the advisor won’t realize it may not be valid, and/or that the advisor won’t have the capacity to fight it.

From the financial advisor’s perspective, this rise of RIA employment agreements with non-compete and non-solicit provisions are a huge challenge. Because it means if you build your career and a client base with your firm, and you decide to leave, you’re likely going to have to start over and leave all your clients behind. To some advisors, this may not seem “fair”, especially if the advisor really did do the work to get the client.

But while this may feel frustrating, from a firm’s perspective, the business takes a lot of risk and assumes a lot of cost to be a platform for you as an advisor. Even if you get the client, you may be doing that with their brand, their resources, and their support.

But in the end, the key thing to realize is that if you are working in an advisory firm, you need to know what your employment agreement actually says, and consider the terms and their ramifications about whether you’ll have to start over before you leave. And because employment law is a state-by-state issue, advisors who are concerned about the restrictions in their employment agreements really need an employment law attorney, in your state, to determine whether a particular non-compete or non-solicit is enforceable in the first place!

Read More…

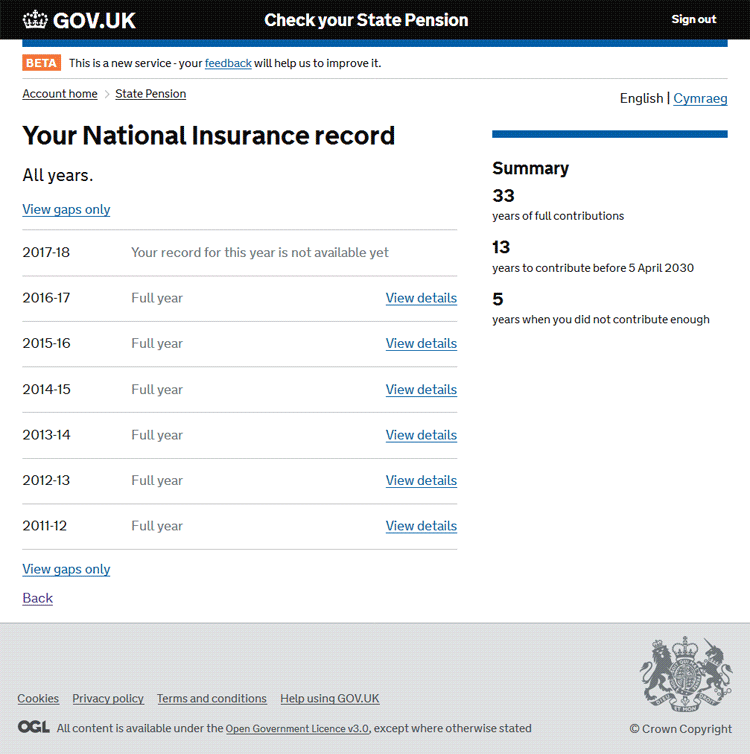

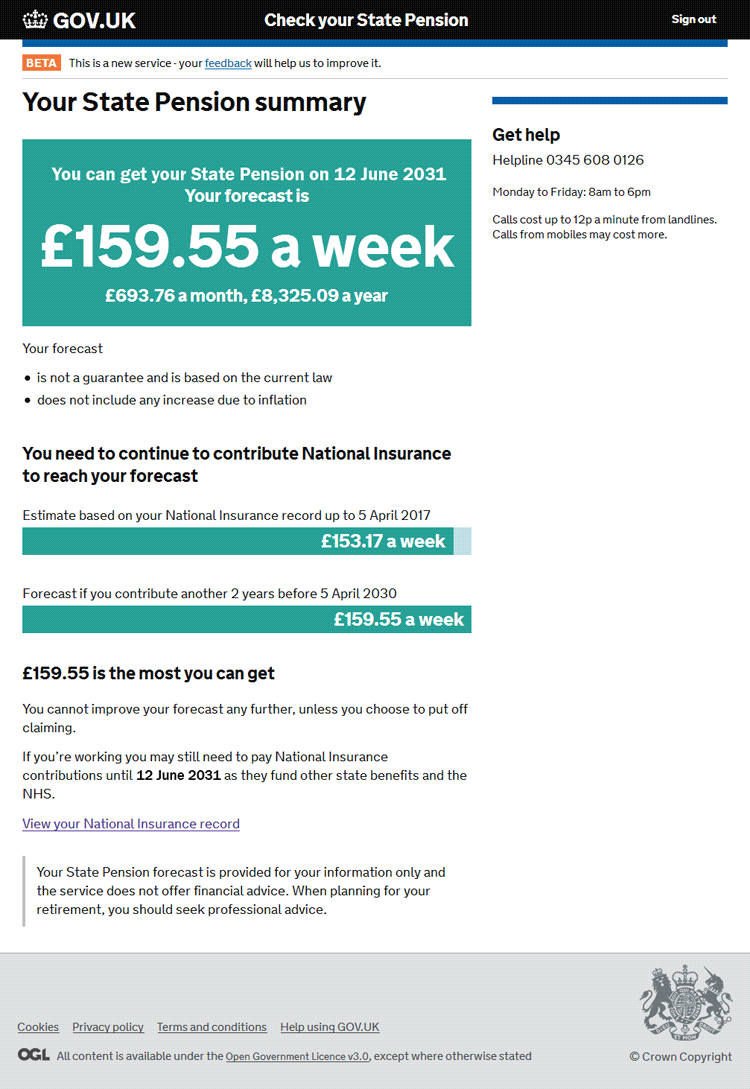

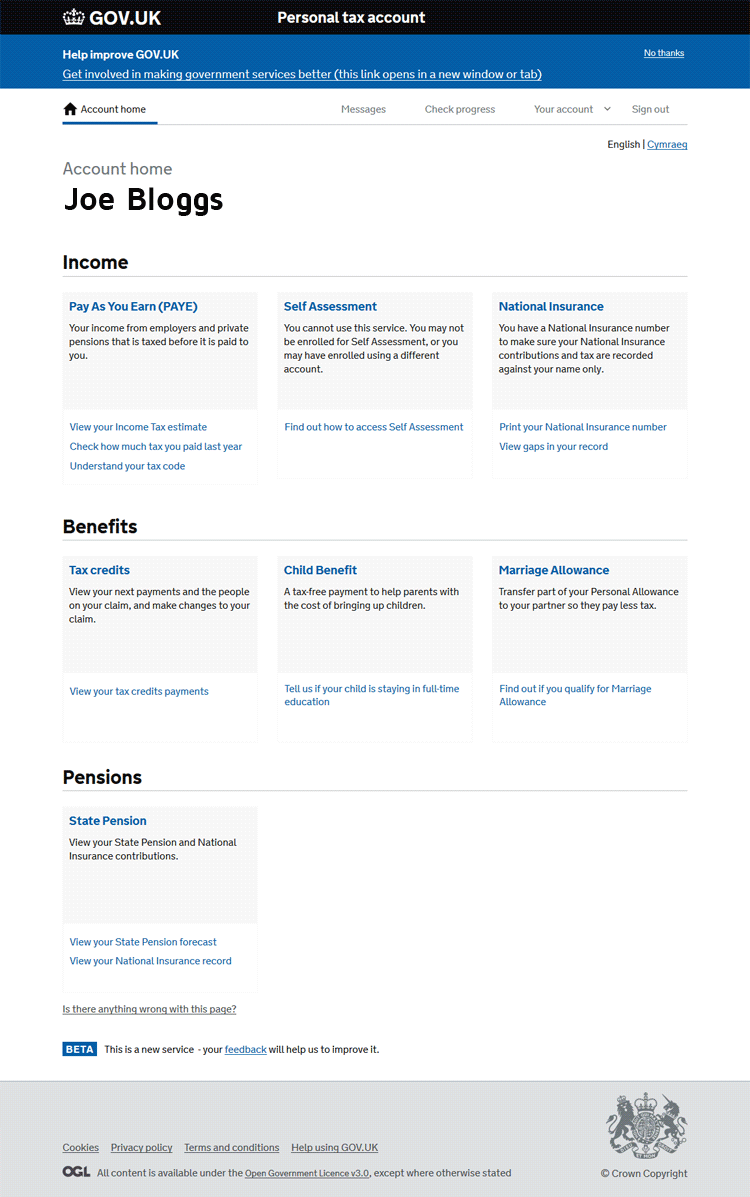

HMRC have been busy, behind the scenes, shaking things up with regard to the personal data they hold on UK taxpayers. They've been pulling in - rather successfully - personal data from various different government departments and bringing all that data into one central place for both them and us to see, whenever the need arises. This is all part of their longer-term plan for Making Tax Digital or 'MTD' as it's known in the tax and accounting world. So, with that in mind, this is the first in a series of posts that introduces MTD and a crucial part of that; Personal Tax Accounts (PTAs). In this series of articles we'll discuss what MTD will mean for most of us, we'll look at the kinds of data that will be stored, see how it'll affect us and, lastly, see if there is anything that we'll need to do.

HMRC have been busy, behind the scenes, shaking things up with regard to the personal data they hold on UK taxpayers. They've been pulling in - rather successfully - personal data from various different government departments and bringing all that data into one central place for both them and us to see, whenever the need arises. This is all part of their longer-term plan for Making Tax Digital or 'MTD' as it's known in the tax and accounting world. So, with that in mind, this is the first in a series of posts that introduces MTD and a crucial part of that; Personal Tax Accounts (PTAs). In this series of articles we'll discuss what MTD will mean for most of us, we'll look at the kinds of data that will be stored, see how it'll affect us and, lastly, see if there is anything that we'll need to do.