Wednesday, 28 February 2018

Can You Claim a Parent as a Dependent?

source https://blog.turbotax.intuit.com/tax-deductions-and-credits-2/family/can-you-claim-a-parent-as-a-dependent-13842/

Is College Most Valuable To Those Who Would Likely Be Successful Without It Anyway?

The “traditional” view of recent decades is that going to college is part of the American Dream, and the essential pathway to better job opportunities with higher income potential. Yet at the same time, there’s growing talk of the financial hardships for students these days, from ever-increasing tuition, to high levels of student debt. Still, under the auspices that a college education is essential to unlocking future income opportunities, students continue to enroll in record numbers. Which raises the question: is college really still a good “investment”, or not?

In this guest post, Dr. Derek Tharp – a Kitces.com Researcher, and a recent Ph.D. graduate from the financial planning program at Kansas State University – examines recent research on the Return On Investment (ROI) from investing in a college education, and particularly the differences in ROI that students may experience based on their own abilities as students, along with their area of study, the type of institution they attend, and the funding that is available to them.

Notably, while the “traditional” view is that a college education is all about building knowledge and developing skills (the “human capital” theory of education), in his 2018 book, The Case Against Education, economist Bryan Caplan examines prior research on education and concludes that the primary function of higher education is actually just to signal certain traits of students to prospective employers – particularly intelligence, work ethic, and conformity (known as the “signaling” theory of education). But setting aside the debate over whether education is primarily a means of developing human capital or signaling (which has some important implications for social returns to investment in education), Caplan’s book contains what might be the most detailed analysis of private returns to investment in education (i.e., the Return on Investment of a college degree for individuals), which is highly relevant to any financial planner who advises clients (or their children, or grandchildren) on whether it’s really still worth trying to invest in a college education in the modern era.

Because while the data is fairly clear that those who go to college do tend to have higher incomes in their working careers, simplistic methods for calculating the ROI from investing in a college education often suffer from “selection bias”, which refers to the fact that those who choose to go to college are not selected at random. For instance, on average, those who choose to go to college tend be more intelligent and harder working than those who do not (a result of the college admissions screening process). Of course, this certainly isn’t true of everyone who does not go to college, but because it’s true on average, we would expect those who go to college to (on average) earn more in the labor market, regardless of whether college actually improved their skills or knowledge, simply because of the intelligence and work ethic they brought with them to college to begin with. Thus, it is important to correct for this “ability bias” when determining the ROI of a college education; Caplan’s calculations, though, go much further than that, adjusting for a wide range of other factors that are often overlooked – from health and happiness, to the probability of unemployment, and even college boredom (or lack thereof).

With this framework in place, Caplan then determines the ROI of a college education across a wide range of scenarios, including student quality (e.g., an excellent student vs. a poor student), type of degree (e.g., Bachelor’s vs. Master’s), a student’s area of study (e.g., engineering vs. fine arts), college quality (e.g., top-tier vs. bottom-tier), and institution type (e.g., public vs. private). In short, Caplan finds that college is a good investment for good students, a mediocre investment for mediocre students, and a bad investment for bad students, who are especially prone to paying for some of college and then not even finishing (incurring the cost/debt but not even getting the signalling benefit of the degree). Beyond that, only the best students should pursue a Master’s degree, field of study does matter (though more so for low quality students), college prestige has a potentially surprisingly small impact, and the best investments are generally found at the top public university where an individual is eligible for in-state tuition (not a leading private college).

Ultimately, Caplan’s analysis has many important considerations for those who may help students choose what type of education to pursue… from not pushing students who are a poor fit to attend college (as this is often the worst case scenario from an ROI perspective, where students may take on all of the expense of a college education yet gain none of the benefits), to helping students who are a strong fit to decide what path makes the most financial sense (and Caplan even makes his spreadsheets publicly available, incase anyone wants to tweak his model to better fit their situation). But the key point is to acknowledge that the ROI of a college investment varies greatly based on the characteristics of a student – primarily by amplifying the positive results for good students, while mostly amplifying the downside risk for bad students – and many other factors that are often overlooked. College may be a great investment for some, but it is not for all!

source https://www.kitces.com/blog/benefits-of-attending-college-signaling-theory-bryan-caplan-case-against-education/?utm_source=rss&utm_medium=rss&utm_campaign=benefits-of-attending-college-signaling-theory-bryan-caplan-case-against-education

Tuesday, 27 February 2018

#FASuccess Ep 061: Starting A Gen X/Y Financial Planning Firm While Also Starting A Family with Mary Beth Storjohann

Welcome, everyone! Welcome to the 61st episode of the Financial Advisor Success Podcast!

My guest on today’s podcast is Mary Beth Storjohann. Mary Beth is the founder of Workable Wealth, a financial planning firm in southern California that in just its first four years has built to more than $200,000 in recurring financial planning fees, serving a Gen X and Gen Y clientele with a combination of upfront planning and ongoing monthly retainer fees.

What’s unique about Mary Beth’s practice, though, is the fact that she’s built it over the past four years while also having two children, who are now 2.5 and 3 months old, respectively.

In this episode, we talk in depth about Mary Beth’s financial planning fee structure, the process she engages in to deliver financial planning value to her typically 30-something or 40-something clientele, why she rarely even uses traditional financial planning software at all for most of her clients, and the unique proactive process she has leveraging software to facilitate regular “check-ins” with clients and actually help ensure they follow-thru and implement all of their financial planning recommendations.

We also talk about how Mary Beth built her own personal support system to help her launch her practice, with a series of Mastermind Study Groups with peer financial advisors at a similar business stage, and an ongoing executive coach relationship to help keep her on task and be her own accountability partner.

And be certain to listen to the end, where Mary Beth shares how she managed to take time off to give birth to her two children, without blowing up the relationship with her clients or losing her marketing and growth momentum, and her suggestions for how female advisors should think through the balancing act of when to start your own firm when you also want to start a family.

So whether you are interested in learning more about profitably serving Gen X and Gen Y clients, have been thinking about joining a Mastermind Study Group of your own, or are interested in how financial advisors can manage the balancing act of starting a firm and starting a family, I hope you enjoy this episode of the Financial Advisor Success podcast!

source https://www.kitces.com/blog/mary-beth-storjohann-workable-wealth-podcast-gen-x-y-professionals-starting-family/?utm_source=rss&utm_medium=rss&utm_campaign=mary-beth-storjohann-workable-wealth-podcast-gen-x-y-professionals-starting-family

Monday, 26 February 2018

First Time Filers: How to Leave the Procrastination Station

source https://blog.turbotax.intuit.com/tax-planning-2/first-time-filers-how-to-leave-the-procrastination-station-33463/

Implementing A Financial Planning (Summer) Internship Program

Implementing a financial planning internship program can be a challenge. From finding good candidates and creating a good job description, to making a hire and getting the intern up to speed in your firm quickly, there is simply a lot to learn and do in a short amount of time. The end result is that many financial planners avoid internships, even though they could be great opportunities for students, firms, the profession, and even your clients!

And the reality is that implementing a financial planning internship program does not need to be an overwhelming task. By implementing a process and onboarding an intern in a thoughtful and systematic way, financial planners can launch a successful internship program, which also helps build a pipeline of talented candidates that firms can hire for future openings.

In this guest post, Jon Yankee of FJY Financial shares how they implemented a financial planning (summer) internship program, from the early stages of finding qualified candidates, all the way through the late stages of the exit interview to get feedback from interns and discover ways that the program can be improved going forward.

The end result of their financial planning internship program has not just been a way to give back to the profession, students, and the CFP Board Registered Programs training the financial planners of the future, but also a direct benefit to the team members at FJY Financial, a talented pool of vetted candidates from which FJY has hired, and an experience working with young financial planners who have enhanced client deliverables for the firm. Of course, it is always a challenge trying to get an intern up to speed in a short amount of time and acclimated to the culture of a new firm, but with a diligently implemented internship program, FJY has been able to bring in 21 summer associates in the 11 years they have operated their internship program!

source https://www.kitces.com/blog/implementing-financial-planning-summer-internship-interview-tasks-yankee-fjy/?utm_source=rss&utm_medium=rss&utm_campaign=implementing-financial-planning-summer-internship-interview-tasks-yankee-fjy

Sunday, 25 February 2018

Sports Gambling and How Your Winnings are Taxed

source https://blog.turbotax.intuit.com/income-and-investments/sports-gambling-and-how-your-winnings-are-taxed-2-17916/

Friday, 23 February 2018

I Completed 30 Rideshares This Year. Am I Considered Self-Employed?

source https://blog.turbotax.intuit.com/self-employed/i-completed-30-rideshares-this-year-am-i-considered-self-employed-33461/

Weekend Reading for Financial Planners (February 24-25)

Enjoy the current installment of “weekend reading for financial planners” – this week’s edition kicks off with the big news that yet another state, Maryland, has now jumped into the fiduciary fray, with its own version of a rule that would require brokers operating in the state to meet a fiduciary standard of care, given ongoing concerns from state legislators about the potential consumer consequences of President Trump’s order to review (and potentially further delay or kill) the Department of Labor’s fiduciary rule. Also in the news this week was a discussion from SEC regulators suggesting that they may be focusing less now on creating new rules for robo-advisors, and instead simply looking to apply the existing principles-based fiduciary regulation under the Investment Advisers Act of 1940 to the robo-advisor business model (with a particular focus on whether robo-advisors, or human advisors using “robo” tools, are probably explaining how broad, or narrow, the scope of their financial advice really is).

From there, we have several articles on the new tax law, including how many small businesses are taking a fresh look at the ideal business entity structure (with some pass-through businesses considering whether to become C corporations for the new 21% corporate rate, and some C corporations considering whether to switch to pass-through status to take advantage of the new 20% Qualified Business Income deduction), a discussion of whether some employee advisors at broker-dealers may want to switch to become independent contracts to take advantage of the new pass-through deduction, how some couples may want to use the “Married Filing Separately” filing status to preserve the pass-through deduction where one spouse is a business owner and the other has (even higher) non-business income, and a look at how the change in tax rates from 2017 to 2018 creates interesting opportunities over the next two months for people to engage in “tax rate arbitrage” by contributing to IRAs for the 2017 tax year and then converting them in the current 2018 year at lower rates.

We also have a few marketing-related articles this week, from tips to squeeze more value out of your client communication and events (by focusing on how to expand the expand or better leverage or re-purpose the content), to how having a narrower niche or target market allows you to build rapport faster with clients by getting to know their common needs and issues (which makes you look like a mind-reader when you can tell them what’s on their minds before they even say it!), and how clients begin to develop a deeper relationship with a professional in as little as 3 extra minutes of the professional listening and making clients feel like they’re heard and cared for.

We wrap up with three interesting articles, all around the theme of selling and business incentives: the first explores a recent research study that finds it’s not the lower fees of robo-advisors that are attracting clients, but the transparency of those fees (and their subsequent performance reporting systems), which has important lessons and implications for all advisors; the second looks at how business model incentives may help to contribute to the unique (and not necessarily pro-long-term-investor) way that brokerage firms typically develop their client statements and websites; and the last provides a good reminder that even if we’re in the business of advice and not product sales that we’re all still selling something to clients, which means perhaps we should focus less on trying to avoid discussions about sales altogether and instead focus more on the most productive ways to ethically “sell” and help clients to reach better financial outcomes!

Enjoy the “light” reading!

source https://www.kitces.com/blog/weekend-reading-for-financial-planners-february-24-25/?utm_source=rss&utm_medium=rss&utm_campaign=weekend-reading-for-financial-planners-february-24-25

5 Tips on How to Talk to Your Significant Other About Money

source https://blog.turbotax.intuit.com/income-and-investments/5-tips-on-how-to-talk-to-your-significant-other-about-money-33472/

Thursday, 22 February 2018

Will Australia’s New Advisor Competency Standards Be A Roadmap For US Regulators?

In recent years, the world has been awash in fiduciary regulatory for financial advisors, from the Future Of Financial Advice (FOFA) reforms in Australia, to the Retail Distribution Review (RDR) changes in the UK, and the Department of Labor’s rule here in the US, all focused on requiring financial advisors to act in the best interests of their clients, and to reduce or eliminate conflicts of interest (especially around commission compensation). Yet while the DoL fiduciary rule has been repeatedly delayed in the US, in many other countries the fiduciary reforms have already taken effect… and now we’re beginning to see the next stage of fiduciary legislation emerge.

In this week’s #OfficeHours with @MichaelKitces, my Tuesday 1PM EST broadcast via Periscope, we examine the new round of financial advisor regulation emerging in Australia, which focuses specifically on competency standards, and what it suggests about what may come next for advisor regulation in the US, and what financial advisors here should be thinking about in order to “future-proof” their own careers against potential future regulation!

Since adopting fiduciary requirements under the FOFA reforms (Future of Financial Advice) in the summer of 2012 and fully implementing those reforms in 2013 (in stark contrast to the ongoing debate in the US over DoL fiduciary which began around the same time but still isn’t fully imiplemented!), Australia has served as a place that advisors can look to see what trends may be coming in the future of financial advisor regulation.

And in that context, Australia has followed up their fiduciary standards with a new round of standards of financial advisor competency, as the reality is that it’s not enough to just have a fiduciary duty for financial advisors to act in the best interests of their clients, but it’s also essential for the advisor to have the technical competency and training needed to know what’s in the best interests of the client in the first place! In essence, the new competency rules would require that all financial advisors have a college Bachelor’s degree, a full professional year of experience, pass a comprehensive exam to demonstrate their competency in core knowledge domains, and commit to ongoing continuing education and ethics requirements. Notably, this is the exact same framework as the CFP Board’s “Four E’s” requirement that already exists in the US: Education, Exam, Experience, and Ethics.

However, just as not even 30% of advisors here in the US have the CFP marks, it is estimated that only about 25% of the financial advisors in Australia will be able to meet the new competency standards there. Accordingly, the regulators are providing a substantial transition period for Australian advisors.

This is important for advisors in the US, as it gives some hint about what may be the next shoe to drop in the regulation of financial advisors here, either in the form of literally requiring the CFP marks to practice – making CFP certification a minimum competency standard for all financial advisors rather than just a voluntary designation – or similar to Australia, some separate-but-similar competency requirement that’s administered directly by a government regulator or an independent entity the regulator creates.

On the plus side, the changes in Australia should not just improve competency to ensure there’s good advice, but also improve consumer trust in financial advisors in the first place. Because even if you show great warmth and caring for clients, if they don’t believe that financial advisors are competent in the first place, it’s difficult to build the necessary trust to have an effective advisor/client relationship. Which is why I think it’s such a big deal that Australia is now rolling out a financial advisor competency standard. Because lifting competency and education standards not only improves the quality of advice, but also trust in financial advisors.

But these changes also mean that, if you’re a financial advisor who wants to “future-proof” your own career, then you really should be reinvesting into advancing your education with programs like CFP certification. As Australia has shown, there will probably be some grace or transition period, so if you’re within 5-10 years of retirement already, you’ll likely be safe to just ride out the status quo. But if you’re younger than that, and still have a longer time horizon in the business, there’s increasingly a risk that once the first round of the fiduciary rule to act in clients’ best interests is done, the next round is going to be about competency standards… which means it may be a good idea to get started future-proofing your own career sooner rather than later! And if you are a CFP certificant today, and you use that to differentiate yourself from the 70% of advisors who don’t, recognize that it’s not going to be a sustainable differentiator for you once the regulators lift the competency standards for everyone… which again highlights the importance of developing your niche and specialization, so that you can stay one step ahead.

The bottom line, though, is just to recognize that much like Australia served as an indicator for what regulation was to come under DoL fiduciary (with a fiduciary rule that took effect 5+ years ahead of the US), Australia’s new adoption of competency standards for financial advisors may be a good indication of where the regulatory focus will be next in a post-fiduciary world in the US. Which means, if you haven’t invested in your education to meet such standards, you may want to start now. And even if you have, it’s important to realize that merely fulfilling the “four E’s” going forward will no longer be a differentiator!

source https://www.kitces.com/blog/australia-financial-advisor-competency-standard-us-fiduciary-duty-of-care-future-proof/?utm_source=rss&utm_medium=rss&utm_campaign=australia-financial-advisor-competency-standard-us-fiduciary-duty-of-care-future-proof

How to Master “Adulting” No Matter Your Age

source https://blog.turbotax.intuit.com/tax-tips/how-to-master-adulting-no-matter-your-age-22711/

Using Your 401k to Reduce Taxable Income

source https://blog.turbotax.intuit.com/income-and-investments/401k-ira-stocks/what-can-you-do-with-your-retirement-fund-to-reduce-taxable-income-30056/

New Side Job: What Do You Need Before Tax Time?

source https://blog.turbotax.intuit.com/income-and-investments/business-income/new-side-job-what-do-you-need-before-tax-time-14807/

Wednesday, 21 February 2018

What’s the Difference Between a Tax Credit and a Tax Deduction?

source https://blog.turbotax.intuit.com/tax-deductions-and-credits-2/whats-the-difference-between-a-tax-credit-and-a-tax-deduction-7838/

New Medicare Premium Surcharge Tier And Other Tax Implications Of The Bipartisan Budget Act of 2018

In today’s contentious legislative environment in Washington, it’s not often that Congress passes any legislation. Which means when a bill actually is on track to be approved, various members of Congress often tack on a number of other provisions that they wish to see approved as well (either individually, or as part of the negotiated process for a compromise to pass the overall legislation).

Thus was the path of the recent Bipartisan Budget Act of 2018 (H.R. 1892), which was passed into law by President Trump on Friday, February 9th. As while it was intended primarily as the legislation that would avoid a government shutdown by agreeing to increase government spending limits and raising the debt ceiling for two years, buried in the legislation were a number of tax-related provisions – some temporary, and others permanent – with impact for both high-income and low-income households.

Of primary note for financial advisors who work with higher-income individuals is that, starting in 2019, there will be a new IRMAA tier for Medicare Part B premium surcharges for individuals earning more than $500,000 (or married couples with AGI in excess of $750,000), stacked on top of what were additional adjustments to the Medicare premium surcharge tiers that just took effect in 2018 as well!

Also included in the legislation were a number of temporary-but-immediate retroactive reinstatements of popular tax provisions for 2017, including the above-the-line education deduction (for those who weren’t already fully eligible for the American Opportunity or Lifetime Learning Tax Credits), the deductibility of mortgage insurance premiums, and relief from any cancellation-of-debt income for those who go through a short sale with an underwater mortgage on their primary residence.

In addition, the Bipartisan Budget Act of 2018 also provides a number of changes to grant more flexibility for hardship distributions from employer retirement plans, authorizes the creation of a new Form 1040SR (an “E-Z” tax filing form for seniors), and provides a number of retirement-plan-related and other tax relief provisions for those who were impacted by the California wildfires in late 2017!

Which means even though the Bipartisan Budget Act of 2018 was nominally “budget legislation” and not a tax law, a number of households may be impacted by its tax-related changes!

source https://www.kitces.com/blog/bipartisan-budget-act-2018-irmaa-medicare-premium-surcharges-tuition-and-fees-deduction/?utm_source=rss&utm_medium=rss&utm_campaign=bipartisan-budget-act-2018-irmaa-medicare-premium-surcharges-tuition-and-fees-deduction

Tuesday, 20 February 2018

I Started a 401K This Year. What Do I Need to Know When I File?

source https://blog.turbotax.intuit.com/income-and-investments/401k-ira-stocks/i-started-a-401k-this-year-what-do-i-need-to-know-when-i-file-33129/

#FASuccess Ep 060: The Written Job Description As A Financial Plan For Employee Talent Development with Kelli Cruz

Welcome, everyone! Welcome to the 60th episode of the Financial Advisor Success Podcast!

My guest on today’s podcast is Kelli Cruz. Kelli is the founder of Cruz Consulting Group, a human resources consulting practice that specializes in working with mid-to-large sized independent financial advisory firms.

In this episode, we talk in depth about the kind of human resources challenges that begin to emerge as an advisory firm grows, especially once it crosses the $100M and then $200M under management thresholds… where the firm grows beyond half a dozen employees – and the founder’s ability to manage them – and suddenly creating the right culture, and designing effective compensation systems that properly incentivize employees, becomes crucial for the business. All of which begins with establishing effective job descriptions for every role in the firm… which Kelli says is like creating a financial plan for employee talent development, forming the basis of what goals the firm and the employee are collectively working towards together.

We also talk about the challenges of hiring dedicated management in an advisory firm, the importance of industry benchmarking studies, how to think about crafting a career track for your employees – especially when your firm isn’t even large enough to have formal career tracks yet – and why the growth and evolution of an advisory firm is all about refining employees into increasingly specialized roles over time.

And be certain to listen to the end, where Kelli shares her thoughts on best practices in setting actual compensation plans, why Kelli believes that the traditional model of paying advisors a percentage of revenue for the clients they manage is a fundamentally unsustainable model for advisory firms that ever hope to scale, how Kelli believes that even sales and business development incentives should only last for 1-3 years, and how firms should balance out the combination of base salary, incentive plans, and sales incentives for various advisory, administrative, and other staff positions in the firm.

So whether you are experiencing your own human resources challenges as your firm grows, have been thinking about hiring dedicated management for your firm, or are interested in how to best structure incentive compensation, I hope you enjoy this episode of the Financial Advisor Success podcast!

source https://www.kitces.com/blog/kelli-cruz-consulting-group-podcast-human-resources-hr-financial-advisor-compensation-incentive-plans/?utm_source=rss&utm_medium=rss&utm_campaign=kelli-cruz-consulting-group-podcast-human-resources-hr-financial-advisor-compensation-incentive-plans

Monday, 19 February 2018

The Handbook For Next Generation Partners Of Independent Advisory Firms

While the CFP certification for financial planning has been around since the early 1970s, it wasn’t until the 1980s and 1990s that it began to gain widespread adoption amongst financial advisors. And it’s only been over the past 20 years or so that the highly scalable AUM model gained enough traction and popularity that the typical advisory firm evolved from solo practices into larger ensemble firms with employee advisors and multiple partners.

As a result, while the essential set of skills needed to establish your own advisory firm are now relatively well known, the most effective path to become a partner in an existing advisory firm is still in its earliest stages, with no set industry norms, a wide variety of career paths from one firm to the next, and a number of firms that haven’t yet designed their formal career tracks at all. Which, to say the least, makes it very difficult for next-generation advisors to figure out where to focus and what to do in order to succeed.

Accordingly, practice management consultant and guru Philip Palaveev has published what should soon become the seminal handbook of next generation advisors pursuing partnership. Because in “G2: Building The Next Generation”, Palaveev – who himself joined a major accounting firm in his early 20s and rapidly ascended to partnership by his early 30s – sets forth exactly what so-called “G2” (second/next generation) advisors in large independent advisory firms should be doing to successfully manage their own career track to partnership, what kinds of expectations are (and are not) realistic, and why (and how) the requisite skills to develop will themselves change as the advisor achieves new levels of success.

Perhaps most notable, though, is the simple fact that at the most senior levels of leadership within an advisory firm, it’s really more about leadership and the ability to manage people, than the actual skill set of being a great advisor. And in turn, the path to leadership and partnership eventually entails growing beyond “just” being a great and expert advisor serving clients, but also learning how to manage and develop a team of subordinates. In addition to learning how to “manage up” to the expectations of founders and senior leadership, with respect to everything from projects and initiatives the advisor might champion, to the advisor’s own career and path to partnership.

Of course, the irony is that when it comes to advisory firms and making partner – like in most industries – success just begets more work and burdens, not to mention a substantial financial commitment to buy in to partnership. Yet at the same time, the good news is that for those who are effective at managing the career marathon, the long-term benefits of becoming a partner – both financial and psychological – can be incredibly rewarding.

source https://www.kitces.com/blog/g2-next-generation-financial-advisor-partner-ria-philip-palaveev-ensemble/?utm_source=rss&utm_medium=rss&utm_campaign=g2-next-generation-financial-advisor-partner-ria-philip-palaveev-ensemble

Friday, 16 February 2018

Weekend Reading for Financial Planners (February 17-18)

Enjoy the current installment of “weekend reading for financial planners” – this week’s edition kicks off with the big news that the Massachusetts state securities regulator has accused retail brokerage firm Scottrade of violating the Department of Labor’s fiduciary rule by holding a series of “sales contests” in the second half of 2017, as even though the full Best Interests Contract Exemption is delayed until the middle of 2019, the requirement to satisfy the Impartial Conduct Standards of the DoL fiduciary rule did take effect last June 9th of 2017… and raising the question of whether Massachusetts will soon be scrutinizing other major firms for similar fiduciary compliance violations. And in a similar vein, the SEC also announced this week new “Share Class Selection Disclosure” Initiative that will grant amnesty to RIAs (especially hybrid RIAs) that may have failed to disclose that they were using higher-cost share classes that included 12b-1 fees (paid to a related broker-dealer) without disclosing that there were lower cost alternatives available (but only if the firm self-discloses its error, and refunds all excess profits earned from clients).

From there, we have several advisor technology articles, including a brief recap of the latest 2018 Advisor Software Survey from Joel Bruckenstein and Bob Veres, two reviews of the big news and announcements at the recent T3 advisor technology conference, and a fascinating profile of some of the major private equity and venture capital investors that have been putting money into the burgeoning number of new advisor tech startups that are well-funded with outside capital and not merely “homegrown” solutions built by advisors themselves and re-sold to their peers.

We also have a few articles on the ongoing trends of advisors retiring, merging, and being acquired, including tips for RIAs that are looking to sell about what they should do to find the right buyer, a look at the landscape for broker-dealer recruiting (which is especially hot amongst the largest independent broker-dealers, who are attracting reps from both wirehouses and smaller IBDs), and some advice from Bob Veres on how advisors should think through their own potential retirement (which isn’t just about the financial matters of selling your practice, but is primarily about finding your own new purpose in a world where your primary focus may no longer be your advisory firm!).

We wrap up with three interesting articles, all around the theme of telecommuting and whether working remotely may not be all it’s cracked up to be: the first looks at how working from home is associated with a dangerous rise in loneliness and isolation, which is both leading employees to want to go back and work from an office again, and can even have deleterious health effects; the second examines how working from home also appears to be impairing everything from the innovation to customer service of a number of large firms, which are shifting from telecommuting and remote work policies to more of a “flexible work” policy that allows some work from home but still requires employees to come into the office on most days; and the last explores the rise of co-working spaces, which provide helpful office space and business infrastructure for those who don’t have a good setup at home, but are proving to be popular primarily because of the social and community aspects of co-working (as contrasted, once again, with the potential isolation and loneliness of working from home). Which means at a minimum, those who are interested in working from home – including solo advisors who don’t have an office – need to be mindful of the need to maintain a social network of friends and colleagues, at least in the form of a co-working space.

Enjoy the “light” reading!

source https://www.kitces.com/blog/weekend-reading-for-financial-planners-february-17-18/?utm_source=rss&utm_medium=rss&utm_campaign=weekend-reading-for-financial-planners-february-17-18

Three Tax Credits for Your Family

source https://blog.turbotax.intuit.com/tax-deductions-and-credits-2/three-tax-credits-for-your-family-12778/

Thursday, 15 February 2018

4 Reasons It’s Great to Be Coupled Up at Tax Time

source https://blog.turbotax.intuit.com/tax-deductions-and-credits-2/family/4-reasons-its-great-to-be-coupled-up-at-tax-time-33350/

Wednesday, 14 February 2018

Understanding The New Pass-Through Business Deduction For Qualified Business Income

It’s long been a tenet of taxation that when a group of individuals come together for a “joint venture”, the taxation of their collective business should simply be done by taxing each individual on their respective share of the business. Over the years, this has been formalized into the structure of “pass-through” business entities, from partnerships to LLCs to S corporations (and of course, the sole proprietor themselves)… all of which simply subjected the business’s income to the tax rates of their individual shareholders.

Until the Tax Cuts and Jobs Act (TCJA) of 2017, which for the first time has introduced a so-called “Qualified Business Income” (QBI) deduction for pass-through entities that will effectively permit pass-through businesses to be taxed on only 80% of their income. To some extent, the introduction of this new QBI deduction was necessary to keep pass-through business tax rates reasonably in line with corporate tax rates (which were also reduced to 21% under TCJA) when stacked on top of qualified dividend or long-term capital gains tax rates. Yet at the same time, the new QBI deduction also introduces a substantial tax planning opportunity… and some complexity, too.

The core of the qualified pass-through business income deduction is that shareholders will simply be permitted to deduct 20% of the business income against itself, which will be claimed as a below-the-line (but not itemized) deduction for tax purposes. However, to prevent abuse – especially at higher income levels – the new QBI rules do not permit the deduction for high-income “Specified Service” businesses (including lawyers, accountants, doctors, consultants, and financial advisors), and high-income individuals may also have their QBI deduction limited if they do not employ a substantial number of people relative to the size of the business (under a new “W-2 wages” limit), or invest into a substantial amount of property (under the “wages-and-property” limit).

The end result of these rules is that small businesses should have relative ease claiming at least a modest new QBI deduction, which is available even if they’re simply a sole proprietor (i.e., it’s not necessary to literally create a pass-through business entity like a partnership, LLC, or S corporation). And large highly scaled businesses may enjoy an even greater deduction. However, businesses that rely primarily on the efforts of their owners – whether overtly as Specified Service businesses, or simply those with a limited amount of employee or capital investments – may still struggle to take advantage of the new QBI rules, especially those over the new income thresholds of $157,500 for individuals, and $315,000 for married couples!

source https://www.kitces.com/blog/pass-through-business-deduction-rules-qualified-business-income-qbi-limits/?utm_source=rss&utm_medium=rss&utm_campaign=pass-through-business-deduction-rules-qualified-business-income-qbi-limits

Tuesday, 13 February 2018

5 Reasons It’s Great to Be Single at Tax Time

source https://blog.turbotax.intuit.com/tax-planning-2/5-reasons-its-great-to-be-single-at-tax-time-33348/

#FASuccess Ep 059: Systematizing The Financial Life Planning Process To Increase Your Money Quotient with Carol Anderson

Welcome, everyone! Welcome to the 59th episode of the Financial Advisor Success Podcast!

My guest on today’s podcast is Carol Anderson. Carol is the founder of Money Quotient, a 501(c)(3) non-profit organization in Portland, Oregon that provides financial life planning training to advisors.

What’s unique about Carol and Money Quotient, though, is the way they have systematized the process of doing financial life planning for clients.

In this episode, we talk in depth about the 5-meeting financial life planning process that Money Quotient has developed, built around their 5-E stages of Explore, Engage, Envision, Enlighten, and Empower, how advisors can use standardized survey tools regarding a prospective client’s financial well-being and potential life transitions eto set a more holistic tone to a financial planning engagement from the start, the way Money Quotient segments the qualitative data gathering process into Satisfaction and Values, Biography, Transitions, and Goals, and the meeting templates they’ve developed to systematize every step of the process along the way.

We also talk about the psychology and sociology research and theoretical framework that underlies the Money Quotient approach – as they are a uniquely research-based organization in developing their financial life planning framework – the 3-day training program they’ve developed to teach advisors about their communication tools, and why Carol doesn’t consider financial life planning to be an alternative to traditional financial planning, and instead simply views it as a better way to help clients develop the self-awareness they need to truly identify the goals that will really improve their own well-being.

And be certain to listen to the end, where Carol shares her own story about developing Money Quotient, the challenges she faced when her initial partnership didn’t work out well, how her daughter ultimately pulled her back into the business, and how Money Quotient is now seeking to grow its own footprint. Because the reality is that the challenges of building a business are equally applicable to both us as financial advisors, and the service providers who work with and train us, too.

So whether you are interested in learning more about Money Quotient’s financial life planning process, curious what insights psychology and sociology may have for financial planners communicating with clients, or want to learn more about building a business servicing financial advisors, I hope you enjoy this episode of the Financial Advisor Success podcast!

source https://www.kitces.com/blog/carol-anderson-money-quotient-podcast-financial-life-planning-tools-iq-eq-mq/?utm_source=rss&utm_medium=rss&utm_campaign=carol-anderson-money-quotient-podcast-financial-life-planning-tools-iq-eq-mq

Monday, 12 February 2018

Tax Reform 101 for Families

source https://blog.turbotax.intuit.com/tax-reform/tax-reform-101-for-families-33144/

12 Tips To Survive Your First 12 Months As An Independent Financial Advisor

While the average financial advisor with 10+ years of experience makes nearly triple the median US household income, the caveat to becoming a financial advisor is that most don’t survive their first few years, and the pressure of getting all your own clients (and persuading them to actually pay you for advice!).

In this guest post, first-year financial planner Shawn Tydlaska shares his own survival tips for having gotten through his first year, on track for more than $100,000 of recurring revenue(!), which he achieved in large part by heavily reinvesting in himself throughout the first year. Of course, reinvesting means that Shawn spent more than many advisors do in trying to start their advisory firms on a low budget… yet at the same time, by focusing on reinvesting his income as it came in, he was able to do so while limiting his actual out-of-pocket costs.

Shawn also shares exactly what kinds of conferences and courses he put himself through to accelerate his growth, how he structured his marketing (and what materials he takes into a typical prospect meeting today), what he tracks in his business, how he leverages his study group, and more!

So whether you’ve been thinking about going out on your own as an independent advisor but aren’t certain what to do, or you’re already in your first few year(s) and looking for fresh ideas about how to better focus, or are an experienced advisor and just want some fresh perspective, I hope you find today’s guest post to be helpful!

source https://www.kitces.com/blog/12-tips-survival-first-year-finanical-planner-fee-only-ria/?utm_source=rss&utm_medium=rss&utm_campaign=12-tips-survival-first-year-finanical-planner-fee-only-ria

Sunday, 11 February 2018

Tax Forms for the Self-Employed

source https://blog.turbotax.intuit.com/self-employed/tax-forms-for-the-self-employed-25094/

Friday, 9 February 2018

How Changes in Your Life Can Save You Money

source https://blog.turbotax.intuit.com/tax-deductions-and-credits-2/how-changes-in-your-life-can-save-you-money-31738/

Government Shutdown Averted and Tax Provisions Providing Tax Relief Passed

source https://blog.turbotax.intuit.com/tax-reform/government-shutdown-averted-and-tax-provisions-providing-tax-relief-passed-33358/

Weekend Reading for Financial Planners (February 10-11)

Enjoy the current installment of “weekend reading for financial planners” – this week’s edition kicks off with some potential talking points to clients about the recent market volatility (and a good reminder that while it’s stressful, this is a time to reinforce your value with clients, and even encourage them to refer other friends and family who may be nervous as well).

Also in the news this week are some new regulatory initiatives around advisory fee disclosures, including both the latest exam priorities from the SEC that are targeting both advisory fees and any less-transparent behind-the-scenes compensation advisors may be earning, and a new standardized “fee table” that Massachusetts may soon start to require all RIAs to use to clearly (and consistently) disclose their compensation.

From there, we have several additional investment-related articles, including a discussion of the implosion $XIV (the short/inverse VIX fund that may have accelerated/amplified the market decline), a look at why the Shiller CAPE ratio deserves more credit than it has being given in recent years, why the rising interest in using actively managed bond funds to deal with potentially rising interest rates may be misplaced, and a strikingly candid discussion from Morningstar on how its new Analyst Ratings have been performing over the past 5 years (and where they can still be improved).

We also have several articles specifically on marketing and business development, from a look at the research on the psychology of referrals and word-of-mouth marketing (hint: it’s all about what the referrer believes he/she can gain in social capital by making the referral, not about helping the advisor being referred!), a good discussion on how closing online prospects who find you via your website is different than the traditional sales process for new clients, and why advisors need to be very careful when promoting any awards or rankings that the firm receives.

We wrap up with three interesting articles, all around the theme of looking differently at common problems: the first looks at how, when we compare income inequality across multiple countries, many of the common explanations for why it is occurring (e.g., decline of unions, rising immigration, etc.) don’t hold up, and that instead it may be the rise of regulatory barriers that are actually insulating and compounding income inequality (especially in professional services, health care, and the financial industry); the second explores how becoming an expert may actually make you more referrable than “just” being a specialist in a niche (though becoming a recognized expert is also arguably harder than “just” focusing on a niche); and the last raises the question of whether the traditional industry mantra “life insurance is sold, not bought” may simply be because historically insurance was so opaque and so hard to buy, and whether the rise of “InsurTech” tools will lead even fee-compensated advisors to increasingly implement insurance recommendations directly for clients, as it becomes easier and easier to actually do so!

Enjoy the “light” reading!

source http://feeds.feedblitz.com/~/524692260/0/kitcesnerdseyeview~Weekend-Reading-for-Financial-Planners-February/

Thursday, 8 February 2018

Where’s My Tax Refund? How to Check Your Refund Status

source https://blog.turbotax.intuit.com/tax-refunds/wheres-my-tax-refund-how-to-check-your-refund-status-18855/

Do I Need to File a 1040 If I’m Self-Employed?

source https://blog.turbotax.intuit.com/self-employed/do-i-need-to-file-a-1040-if-im-self-employed-33045/

What This Week’s Market Volatility Teaches About Making Customized Portfolios For Every Client

The big news this week was the “record-breaking” drop (at least in absolute point decline) in the stock market on Monday, the incredible blow-out of the VIX, and the challenge that inevitable comes when market volatility rises: the need to check in with clients, talk them through what’s happening in the markets, evaluate whether it’s necessary to make any portfolio changes, and try to talk them off a ledge if they’re really freaking out. But the reality is that being able to proactive communicate with clients, and have effective client meetings, during times of market volatility, is actually heavily impacted by how you construct your client portfolios in the first place, and the extent to which you customize those portfolios for each client.

In this week’s #OfficeHours with @MichaelKitces, my Tuesday 1PM EST broadcast via Periscope, we examine the problem with financial advisors customizing every client portfolio, particularly once we experience volatile markets, and how financial advisors (and asset managers) should look at “customization” going forward!

In a world where advisors are trying to become less product-centric and add more value to clients, there does appear to be a nascent trend of advisors trying to create more customized portfolios for clients. Though this idea isn’t exactly new (it has occurred for decades in the form of selecting stocks and mutual funds for clients and adapting at every client review meeting), the rise of rebalancing software (or “model management” software tools more broadly), has made it easier to systematize the process of customizing individual client portfolios, while still being able to monitor and manage them centrally.

But I think this week’s market volatility is actually a really good example of the problem that arises with trying to create drastically customized and different portfolios for every client: if every client has their own “customized” portfolio, then it is really hard to keep track of all of your different clients and their portfolios. And so, instead of being able to easily send out broadly applicable communication to your client base, you’ll end up spending an hour to prep for every meeting and write every personalized client email during volatile market times. Simply put, customizing every client portfolio isn’t scalable for the client relationship itself (regardless of the scalable back-office technology to support it).

The challenges of the trend towards customization is notable with respect to asset managers as well. Because asset managers are – justifiably, I think – afraid of their future in a world where advisors are less product-centric, and looking to retool their own businesses. And the discussion I’m hearing more and more from those asset managers is “if advisors don’t want to use standard mutual fund products anymore, then we have to pivot and go the other direction. From products to customization instead!” But here’s the problem: when we look at the advisory firms adopting ETFs and eliminating mutual fund products, they’re not really customizing that much anyway. Even advisory firms that have dropped mutual funds and are building model ETF portfolios, not customized ETF portfolio (allowing them to keep charging their 1% fee while disintermediating the cost of the mutual fund manager, and effectively turning themselves into portfolio managers). So the real shift is that the client buys the investment “product” from the advisor and the advisor’s firm, not from the mutual fund company or other asset managers. The opposite of product isn’t customization. The opposite of product is advisor. When our value proposition is based on what we do, we don’t want to sell a third-party product, of any type. We want to sell ourselves!

So where does all of this leave us? From the advisor’s perspective, and particularly for those of you who are now struggling to figure out how to assess the damage of this week’s market volatility because all of your clients have “customized” portfolios… let this be a call-to-action for you of how not scalable you’re making the client relationship management needs of your business. There are a lot of firms that are growing just fine without customizing every single portfolio differently for every client. There may be times when some customization is still needed, but it is better to customize from a planning perspective (e.g., for tax purposes) rather than an investment perspective.

And for Asset Managers, particularly mutual fund managers, trying to figure out how to reach advisors and stay relevant… I can only caution you that the push towards making more customized solutions is not likely to work out well for you. If you want to stay relevant as financial advisors transition from salespeople to actual advisors, figure out how to make better products that cost less and are truly best in class at what they do. Because as advisors, if you can pass our screens and get to the top of the list, you get all of our money in that fund or category. And if you can’t, you’re never going to get in the door in the first place anymore.

The bottom line, though, is just to recognize that customizing portfolios for every client is simply not a scalable model, not because of technology limitations but in light of the stress and communication challenges that come with trying to help our clients through volatile markets. Which means this may be a great opportunity to begin the process of standardizing your investment process (if you haven’t already) so that you can actually be more proactive with clients, when you’re not spending all that time re-analyzing every client’s portfolio one at a time!

source https://www.kitces.com/blog/market-volatility-customized-client-portfolio-rebalancing-model-management-client-relationship/?utm_source=rss&utm_medium=rss&utm_campaign=market-volatility-customized-client-portfolio-rebalancing-model-management-client-relationship

Wednesday, 7 February 2018

Who Can I Claim As a Dependent?

source https://blog.turbotax.intuit.com/tax-deductions-and-credits-2/family/who-can-i-claim-as-a-dependent-7658/

Why Good Financial Behavior Isn’t Achievable Until You Believe That It Is

As almost all financial advisors have experienced, instilling behavior change in clients can be a tough task. Though we can easily see ways in which clients could improve their behavior for the better (which are often known by clients as well), the reality is that merely telling clients about how they can improve their behavior is rarely enough to actually get them to do so. While there are many reasons why this could be the case, one common barrier to behavior change is that if the client isn’t self-confident in his/her own ability to successfully make the change in the first place – lacking the “self-efficacy” to be successful – then the change simply doesn’t happen.

In this guest post, Dr. Derek Tharp – a Kitces.com Researcher, and a recent Ph.D. graduate from the financial planning program at Kansas State University – examines the concept of financial self-efficacy (i.e., one’s confidence in their ability to complete a financial task), and looks at how research might suggest that financial advisors can help their clients build greater levels of confidence in their own ability to actually engage in (and therefore adopt) better financial behaviors.

Though it is not a term that is as popular outside of academic circles, “self-efficacy” is a broader concept which refers to one’s confidence in their ability to engage in a particular behavior. Growing out of research related to positive psychology (the study of what makes people flourish), self-efficacy has been found to be an important concept related to promoting good behavior in many areas of life. Though research specifically within a financial planning context is still limited, some early findings suggest that promoting the practice tenets of positive psychology captured within the PERMA framework – which posits that Positive emotions, deep Engagement in activities, worthwhile Relationships, finding Meaning in one’s life, and Achieving a sense of accomplishment – may be ways in which financial advisors can help clients improve their financial self-efficacy.

Additional research on self-efficacy more generally suggests that performance accomplishments (e.g., helping our clients develop skills that they need to be confident in taking action), vicarious experience (e.g., serving as a good financial role model for our clients), verbal persuasion (e.g., providing encouragement when our clients need some financial coaching), and emotional arousal (e.g., encouraging/discouraging financial decision making when clients are in ideal/non-ideal levels of emotional activation) may all be effective ways that financial planners can help their clients build financial self-efficacy. As a result, financial planners who wish to help their clients implement better financial behaviors should not ignore the potential power of promoting financial self-efficacy. When it comes to helping clients make good decisions, helping clients believe they can accomplish the financial behavior in the first place is crucial!

source https://www.kitces.com/blog/financial-self-efficacy-bandura-positive-psychology-planning-perma/?utm_source=rss&utm_medium=rss&utm_campaign=financial-self-efficacy-bandura-positive-psychology-planning-perma

Tuesday, 6 February 2018

#FASuccess Ep 058: Custom Designing Your Office For A Better Data Gathering Experience with David Armstrong

Welcome, everyone! Welcome to the 58th episode of the Financial Advisor Success Podcast!

My guest on today’s podcast is David Armstrong. David is the co-founder of Monument Wealth Management, a hybrid RIA in the Washington DC area that serves 120 families and oversees nearly $300 million of assets under management with a team of 11 people.

What’s unique about David’s business, though, is the way that he’s evolved the business over time, having built his early career under a broker-dealer, then shifting to a hybrid arrangement with an outside SEC-registered RIA that is separate from his broker-dealer, and steadily dialing down his amount of broker-dealer business over time as he shifts increasingly towards an AUM-based wealth management model to serve his clients.

In this episode, we talk in depth about the way that David has focused the firm over time towards clients who have created their wealth through a business or other liquidity event, their Ensemble approach where every client is truly a client of the firm and not just a particular advisor, the way Monument Wealth Management has structured their team into Client Services, Financial Planning, and Asset Management, and how the firm has systematized everything from their financial planning deliverables, to their path to partnership, the using of an engagement letter before taking on a client, and even their data gathering process.

In fact, we talk in depth about the way David structures his data gathering process with clients in particular, by creating an interactive experience using a series of conference room white boards to collect information – and help clients actually see and visualize their own financial situation – in a physical space in his office that was first built as a “thinking room” and then become the planning and discovery room specifically to support this process with clients… culminating in a physical deliverable to clients that David calls their “Monument Blueprint”, and becomes the basis for subsequently building out the client’s entire financial plan.

And be certain to listen to the end, where David also shares his unique hiring process to find great staff to join the firm, which includes a job description that explains not only the nature of the job and the tasks that it entails, but an in-depth discussion of the values of the firm that every candidate should be interested in before they work there, and a lengthy list of all the reasons that a potential candidate should not take the job… just to ensure they really screen out those who wouldn’t be a good cultural fit anyway!

So whether you are interested in learning more about transitioning away from a broker-dealer business to an AUM-based RIA business, curious how you can grow your business through a more interactive data gathering process, or simply want to learn more about how you can find great staff to join your team, I hope you enjoy this episode of the Financial Advisor Success podcast!

source https://www.kitces.com/blog/david-armstrong-monument-wealth-management-podcast-blueprint-data-gathering-meeting-hiring-process/?utm_source=rss&utm_medium=rss&utm_campaign=david-armstrong-monument-wealth-management-podcast-blueprint-data-gathering-meeting-hiring-process

Monday, 5 February 2018

Don’t Let Filing Multiple W-2s Scare You

source https://blog.turbotax.intuit.com/taxes-101/dont-let-filing-multiple-w-2s-scare-you-3714/

The Latest In Financial Advisor #FinTech (February 2018)

Welcome to the February 2018 issue of the Latest News in Financial Advisor #FinTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors and wealth management!

This month’s edition kicks off with the big news that “robo-advisor-for-advisors” AdvisorEngine has acquired Junxure CRM, it what appears to be both an effort to expand its investment management platform to include a core CRM component… and also perhaps an effort to turbocharge its own growth by trying to acquire a base of (Junxure) CRM users to cross-sell AdvisorEngine. Though it remains to be seen whether advisory firms will be willing to adopt AdvisorEngine’s basis-point pricing for a back-office technology solution!

From there, the latest highlights also include a number of interesting advisor technology announcements, including:

- Overstock.com launches a robo-advisor, in what may actually just be a prelude to trying to launch a blockchain-driven alternative trading system for stocks

- NextCapital raises a $30M Series C round to fund its target-date-fund-disrupting “robo” tools for 401(k) plans

- Orion Advisor Services launches its new ASTRO solution to bring direct indexing to financial advisors

- TD Ameritrade finally launches its Model Market Center, putting TAMPs to the test (or at least newfound price pressure) about whether advisors really want to outsource investment model implementation services in the face of increasingly sophisticated rebalancing software tools

- AdvicePay launches its compliant fee-for-service payment processing platform for all financial advisors

Read the analysis about these announcements, and a discussion of more trends in advisor technology in this month’s column, including CellTrust’s big push into compliant text messaging solution for financial advisors, whether BondNavigator will gain traction as advisors increasingly buy individual bonds in the face of a potential rising interest rate environment, a new solution from Healthview Services called HealthyCapital that aims to help clients quantify the financial benefits of getting healthier (at least, for the subset of advisors who provide truly holistic advice on financial and physical well-being), how Wealthfront is finding newfound growth by developing increasingly sophisticated direct-to-consumer financial planning software, and the pivot of portfolio crash testing software RiXtrema into the hot DoL fiduciary #RegTech segment of the advisor technology world.

I hope you’re continuing to find this new column on financial advisor technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to TechNews@kitces.com!

source https://www.kitces.com/blog/the-latest-in-financial-advisor-fintech-february-2018/?utm_source=rss&utm_medium=rss&utm_campaign=the-latest-in-financial-advisor-fintech-february-2018

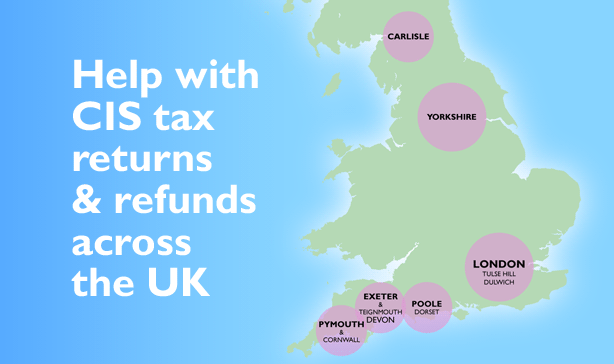

Help with CIS Tax Returns & Refunds Across the UK

As well as having 2 London based teams dealing with CIS returns and refunds, we've now introduced the same service for clients who are further afield in the UK. If you are a CIS contractor or sub-contractor we now have tax help available in the South West, the North East, the North West and, of course, our existing services in London and the South East of England. More specifically, we can help you if you are:

As well as having 2 London based teams dealing with CIS returns and refunds, we've now introduced the same service for clients who are further afield in the UK. If you are a CIS contractor or sub-contractor we now have tax help available in the South West, the North East, the North West and, of course, our existing services in London and the South East of England. More specifically, we can help you if you are:

- in Cornwall/Devon (within a 30 mile radius of the Plymouth PL12 post code),

- in Yorkshire in the North East (within a 50 mile radius of S72 post code area),

- in the Carlisle region in the North of England,

- in or around Exeter, Topsham, Plymouth & Teignmouth in Devon,

- and also around the Poole area of Dorset.

- Of course, that's on top of the existing bases in Tulse Hill and Dulwich in South London.

source http://www.taxfile.co.uk/2018/02/cis-help-across-uk/

Saturday, 3 February 2018

Taxfile: Your One-Stop Tax & Accountancy Shop

Taxfile has over 100 years of combined tax and accounting experience. It's incredible to think that the key personnel have administered over 30,000 tax submissions in the past 20 years! Beginning way back in 1994 (and continuing as Guy Bridger Limited from 1997), we originally started business offering only CIS sub-contractor returns but quickly developed the service to help the self-employed, local businesses and higher rate taxpayers with their tax computations. Along the way we added tax and accounting services for taxi drivers, cab drivers, landlords and more. We also offer Capital Gains tax expertise and tax investigation help and, more recently, professional help with disclosures, written tax advice and tax planning for things like inheritance. We have exceptional accounting experience in all key tax and accounting areas including:

Taxfile has over 100 years of combined tax and accounting experience. It's incredible to think that the key personnel have administered over 30,000 tax submissions in the past 20 years! Beginning way back in 1994 (and continuing as Guy Bridger Limited from 1997), we originally started business offering only CIS sub-contractor returns but quickly developed the service to help the self-employed, local businesses and higher rate taxpayers with their tax computations. Along the way we added tax and accounting services for taxi drivers, cab drivers, landlords and more. We also offer Capital Gains tax expertise and tax investigation help and, more recently, professional help with disclosures, written tax advice and tax planning for things like inheritance. We have exceptional accounting experience in all key tax and accounting areas including:

- CIS computations, CIS returns and refunds for sub-contractors and limited companies in the construction industry,

- Tax, tax returns and accountancy for the self-employed, small businesses, partnerships etc.,

- Tax help for taxi drivers and cab drivers,

- Tax help for landlords,

- Tax help for limited companies,

- Tax help for directors,

- Payroll services,

- Bookkeeping,

- VAT including VAT registrations, VAT returns and VAT accounting,

- Corporation tax,

- Capital Gains Tax (CGT),

- Year end accounts for SME's, partnerships and limited companies,

- Non-domicile taxes/foreign taxes,

- PAYE and National Insurance Contributions (NIC),

- Company registrations,

- Auto Enrolment for Workplace Pensions

- and just about any other tax and accounting-related assistance you can think of.

source http://www.taxfile.co.uk/2018/02/one-stop-tax-accountancy-shop/

Friday, 2 February 2018

What Are the 2018 Standard Mileage Rates?

source https://blog.turbotax.intuit.com/tax-deductions-and-credits-2/what-are-the-2018-standard-mileage-rates-33278/

Weekend Reading for Financial Planners (February 2-3)

Enjoy the current installment of “weekend reading for financial planners” – this week’s edition kicks off with an interesting retrospective look at the impact of the Financial Planning Association’s successful lawsuit against the SEC 10 years ago, which set in motion much of the past decade’s fiduciary rulemaking debate, the rapid rise of the hybrid B/D-RIA movement, and spurred the growth of the independent RIA channel… though, ironically, not the organization’s own membership, which remains down nearly 15% from before the lawsuit was first filed.

From there, we have a series of practice management articles this week, including: a look at the challenge in transitioning from a practice into a business (which becomes a virtual necessity as an advisory firm approaches $2M of revenue); the importance of developing talent internally, which in turn requires having a clear multi-step progression of how an advisor can grow over time from a paraplanner to an advisor and even a partner; tips on how to refine your own hiring process (and why it’s so crucial to do so); and a warning from Mark Tibergien that while advisory firms are still growing, they’re increasingly buoyed by just market returns as organic growth rates are slowing, raising the question of whether it’s finally time for advisory firms to begin building more formal marketing processes.

We also have several articles specifically on marketing and business development, from a discussion of the path that prospects go through in considering a financial advisor (and why it’s necessary to customize your own sales process depending on what stage they’re in), to strategies for improving your new client onboarding process to make people want to refer from the very start of working with you, why an “elevator pitch” is still a necessity in today’s world, and why good branding in the modern era of information overload is less about finding a cute or clever way to describe yourself and increasingly about just being really clear about what you do and who you serve (so the prospects who would actually be interested can quickly and easily find you!).

We wrap up with three interesting articles, all around the theme of milestones and personal growth: the first is an excerpt from Daniel Pink’s new book “When”, looking at how having “temporal landmarks” (from a deadline to a birthday that turns a new decade) can spur us to get things done or take on new challenges; the second is a fun series of “life tips” from someone turning 45 and looking back on all she wish she knew in her earlier years; and the last is an interesting exploration of why it may not always be a good idea to set “SMART” goals (that are specific and concrete), and how setting goals can actually distract us from both enjoying the journey, and missing the new opportunities that may come along the way!

Enjoy the “light” reading!

source https://www.kitces.com/blog/weekend-reading-for-financial-planners-february-2-3/?utm_source=rss&utm_medium=rss&utm_campaign=weekend-reading-for-financial-planners-february-2-3

New: Tax Advice & Planning Service

You can also get tax planning and tax advice from Taxfile. We have highly experienced senior accounting staff who can give you the right tax advice when you need it most — for example, when your circumstances are changing, if you've had trouble keeping on top of your tax commitments and need to bring things up to date, or perhaps a friend or relative simply needs a bit of reassurance with regard to their tax situation. Perhaps you are due to inherit from a relative or have recently made a tidy profit trading crypto coins like Bitcoin and want to know where you are from the standpoint of Capital Gains or Income Tax. Those are all examples of typical situations where our new Professional Tax Advice and Tax Planning services can help you to see the wood from the trees.

You can also get tax planning and tax advice from Taxfile. We have highly experienced senior accounting staff who can give you the right tax advice when you need it most — for example, when your circumstances are changing, if you've had trouble keeping on top of your tax commitments and need to bring things up to date, or perhaps a friend or relative simply needs a bit of reassurance with regard to their tax situation. Perhaps you are due to inherit from a relative or have recently made a tidy profit trading crypto coins like Bitcoin and want to know where you are from the standpoint of Capital Gains or Income Tax. Those are all examples of typical situations where our new Professional Tax Advice and Tax Planning services can help you to see the wood from the trees.

A Free Telephone Consultation

In the first instance, we are inviting clients to speak for just 15 minutes with our resident tax planning expert, Colin Lothian. This will be in the form of a free, introductory telephone call, perhaps in February or March if it suits you. We can then see what's needed and take it from there. We can, of course, discuss any costs with you before you commit to anything further, and there is no obligation. Whether it's about labour taxes, investment taxes, business taxes, disclosures to HMRC or inheritance planning, Colin can make sense of all the options for you and help to make sure you are paying no more tax than you should do. With over 40 years' experience in accountancy and tax planning, Colin knows exactly what's what when it comes to tax, so can definitely help you. Call 0208 761 8000 to arrange your free 15 minute telephone appointment with Colin, at a mutually convenient time. Alternativelysource http://www.taxfile.co.uk/2018/02/new-tax-advice-planning-service/