Thursday, 31 May 2018

8 Wellness Tips to Follow This Summer

source https://blog.turbotax.intuit.com/income-and-investments/8-wellness-tips-to-follow-this-summer-40935/

Wednesday, 30 May 2018

How Should An “Endowment-Style” Donor Advised Fund Be Allocated?

Donor advised funds (DAFs) are flexible tools which can be used for a number of charitable giving purposes. One increasingly popular use is to use a DAF in lieu of a private foundation, given that DAFs are cheaper to operate, more tax efficient, more flexible, and eligible for higher limits on tax deductibility of contributions. For those with charitable intentions of leaving a legacy that will continue to have an impact on the world many years into the future, an “endowment-style” DAF may be a great alternative to a traditional perpetual foundation. However, while much attention has been given to how individuals should allocate a portfolio throughout their own lifespan, considerably less attention has been given to the question of how to best allocate a portfolio if one’s time horizon is “forever”.

In this guest post, Dr. Derek Tharp – a Kitces.com Researcher, and a recent Ph.D. graduate from the financial planning program at Kansas State University – analyzes considerations when coordinating investment and spending policies of an endowment-style DAF, finding that for donors who have the willingness to be flexible in their distribution policy, investment allocations that are much more aggressive than those commonly adopted by endowments may generate far more income for charitable beneficiaries and build a larger endowment value to sustain giving well into the future.

For many, the first place to look for guidance on endowment allocations may naturally seem to be the many colleges and universities managing endowments – ranging from the multibillion-dollar endowments at some of the most prestigious universities in the world, to the fairly modest endowments of smaller, regional universities. However, despite the attention that these endowments often get, this may not be the best approach for donors, as the reality is that colleges and universities have a much higher need for distribution stability (in order to fund ongoing operating costs that universities have become highly dependent on) than the typical donor funding institutions which are not dependent on a single donor’s gifts. Which means, despite the fact that many smaller universities tend to build endowment allocations roughly akin to a 60/40 or 70/30 portfolio, an ideal allocation for a typical donor may look much different.

As it turns out, allocation considerations can have a tremendous impact on the amount of funds that ultimately go to charities, although the uniqueness of a 100+ year time horizon (relative to the 30-40 year time horizons financial advisors are more familiar with) makes the size of the impact hard to intuitively grasp. For instance, Monte Carlo analysis based on historical market returns suggests that shifting a fairly modest $100k endowment-style DAF from a balanced portfolio allocation (50/50) to an aggressive allocation (100/0) would result in an extra $13.6 million in inflation-adjusted median endowment account value after 100 years, while generating an addition $5.6 million in distributions to charitable institutions along the way! Further, adopting a simple dynamic spending strategy (e.g., forego a distribution in years with less than a 2.5% real return), results in an additional $6.1 million boost in real residual value and $1.2 million more in charitable distributions, despite the fact that distributions are being skipped in some years!

Ultimately, the key point is to acknowledge that willingness to accept some spending instability can result in substantially more assets going to the charitable institutions that donors care about. Of course, donors must be willing to stay the course, avoid projecting their personal risk tolerance onto the endowment, and be comfortable adopting an allocation that is much more aggressive than the “norm” among prominent endowments… but donors should be cognizant of the tremendous potential if they are willing to be flexible. The long-term compounding effects are huge!

source https://www.kitces.com/blog/donor-advised-fund-daf-endowment-style-asset-allocation/?utm_source=rss&utm_medium=rss&utm_campaign=donor-advised-fund-daf-endowment-style-asset-allocation

Tuesday, 29 May 2018

#FASuccess Ep 074: Why Solo Financial Advisor Success Is All About Self-Confidence In Your Own Value with Diane MacPhee

Welcome, everyone! Welcome to the 74th episode of the Financial Advisor Success Podcast!

My guest on today’s podcast is Diane MacPhee. Diane is the founder of DMAC Consulting, a financial advisor coaching and practice management consulting firm that specializes in solo and emerging ensemble advisory firms.

What’s unique about Diane, though, is that before she was a coach for financial advisors, she was a fee-only financial planner herself for 16 years, and as a result brings a unique perspective with both the experience of a financial advisor and the training of being a professional certified coach.

In this episode, we talk in depth about the challenges of being a successful solo financial advisor, the self-limiting beliefs we sometimes inflict on ourselves that prevents us from growing and being as successful as we could be, why it’s so hard to set the “right” fee for clients (and especially to raise fees when we should), and why the #1 element to success as an advisor is to really find and get control of your own self-confidence, so you can confidently articulate your value to clients and prospects.

We also talk about strategies to break through when you hit “The Wall” in your practice – that point where you’re at capacity with the number of clients you serve, and you can start to feel tired, or overwhelmed, or outright drowning in your own practice – and why eventually, the key to continued success is not about figuring out how to hire more staff or use technology more efficiently or new marketing ideas to grow and add more clients, but how to transition to the right clients for you… even if that means it’s time for an “amicable termination” from some of your existing clients.

And be certain to listen to the end, where we talk about the key transition to make if you do want to grow into an ensemble practice beyond yourself… which is all about hiring people you can trust, and learning to let go and not be the bottleneck in your own advisory firm. Which, unfortunately, is much easier said than done.

So whether you are interested in learning more about the challenges of being a successful solo financial advisor, are interested in how to identify the right clients for you, or are wondering how you can build a true ensemble firm that extends beyond yourself, I hope you enjoy this episode of the Financial Advisor Success podcast!

source https://www.kitces.com/blog/diane-macphee-dmac-consulting-services-podcast-financial-advisor-coach-pcc/?utm_source=rss&utm_medium=rss&utm_campaign=diane-macphee-dmac-consulting-services-podcast-financial-advisor-coach-pcc

Monday, 28 May 2018

Raising AdvicePay Capital And How Misaligned VC Incentives Strangle Advisor FinTech Innovation

Starting a business from scratch is a risky endeavor, in which often those who put money into the business never even see a return of their money, much less a return on their investment. Which can be especially damaging for a founder who sinks their life savings into a business idea that doesn’t work out… or worse, doesn’t have enough money to put in to get a good idea for a company off the ground in the first place.

Fortunately, though, venture capital firms exist to help fund these high-risk entrepreneurial endeavors. Because for a VC fund, it’s not necessary for every company to succeed; the venture fund can be profitable in the aggregate and generate an appealing return on capital by diversifying across multiple startups, leveraging the power of diversification and the fact that the high risk also generates a very high return potential… such that 80% of the returns may be driven by only 20% of the companies, or in the extreme almost all the returns may come from just 1-2 “home run” investment opportunities that become huge.

Yet the challenge of this kind of ultra-high-risk-and-high-return investing is that VC funds will often shy away from viable business opportunities that are not deemed to be “big enough” to be the home runs necessary to make up for all the potential losses of the companies that don’t work out. Or alternatively, may invest into companies but push the founders to take more risk than they actually wanted to… as while a “Go Big Or Go Bust” approach may work for a diversified VC fund, it can be ruinous to the founder that has only their one company to be a part of!

The end result of this dynamic, particularly in a limited-size “niche” industry like financial advisors, is that few venture capital firms – even those focused on FinTech – actually have any interest in investing in advisor technology, where most of the “successful” companies may eventually sold for $10s of millions… but not the $100s of millions, or billions, that most VC firms are shooting for. Thus why investing in B2C robo-advisors – with their potential for 100+ million consumer households – was more compelling to most venture firms than funding the equivalent next-generation onboarding-and-rebalancing-software solutions for financial advisors.

In turn, this has driven the overwhelming majority of advisor technology innovation to be limited to what companies can be created for advisors, by advisors, and often funded by advisors as well – in a world where the potential to earn “bad” 15% – 20% returns for a VC fund are still “great” returns for an individual advisor-as-investor (whose primary alternative is the stock market). From Junxure to Redtail, to Orion and Tamarac, iRebal and TradeWarrior and Red/Black, RiskPro and Tolerisk… most advisor technology innovation is advisor funded.

Accordingly, we’re excited to announce that our own AdvicePay payment processing solution for financial advisors is opening an extension to its prior Seed round, raising up to $2M of capital directly from the financial advisor community (at least, those who are eligible Accredited Investors!). Because in the end, it seems the only way that technology will improve for financial advisors is to invest in making it happen ourselves!

source https://www.kitces.com/blog/raising-capital-advicepay-misaligned-vc-fintech-innovation/?utm_source=rss&utm_medium=rss&utm_campaign=raising-capital-advicepay-misaligned-vc-fintech-innovation

Sunday, 27 May 2018

Memorial Day Saving Tips for Our Troops

source https://blog.turbotax.intuit.com/income-and-investments/memorial-day-saving-tips-for-our-troops-17158/

Thursday, 24 May 2018

Why RIA Custodians Should Start Charging A Basis Point Custody Fee

A custodian is one of the most crucial vendors for RIAs that manage client assets. From the core custodial services of trading and holding and keeping records of electronically-owned securities, to the ancillary technology that custodians provide to help advisors run their business, a good RIA custodial relationship can help firms attract and retain clients. However, as the advisory industry has shifted from a focus on sales to advice, custodians and the RIAs they serve are increasingly in conflict with one another, as many of the ways in which RIAs can help their clients reduce costs and further grow their wealth (reducing unnecessary trading costs, seeking out the best cash options, etc.) are actually detrimental to the bottom lines of the RIA custodians they use!

In this week’s #OfficeHours with @MichaelKitces, my Tuesday 1PM EST broadcast via Periscope, we discuss why RIA custodians should start charging the RIAs they serve a custody fee, and why a basis-point custody fee would ultimately better align the interests of RIAs and the custodians that serve them, allowing custodians to actually focus on providing the best services and solutions to RIAs, instead of just seeking new ways to make money off of an RIA’s clients instead!

To better understand why an RIA custody fee would be an improvement relative to the status quo, it is helpful to first look at how RIA custodial platforms actually make their money in the first place. In practice, most RIA custodians make money in three ways: (1) earning money on cash (either through the expense ratio of a proprietary money market fund, or by sweeping the cash to a related bank subsidiary), (2) servicing fees for mutual funds and ETFs, such as sub-TA fees along with 12b-1s via “No Transaction Fee” (NTF) platforms, and (3) ticket charges earned whenever a client makes a trade. In practice, many of these fees may ultimately be trivial to the end consumer (e.g., it’s unlikely a 50 basis point fee on a 1% cash position is going to make or break a client’s retirement), but when companies like Charles Schwab have almost 1.5 trillion dollars on their RIA platform, these expenses result in substantial revenues for RIA platforms when aggregated across all clients… albeit at the direct expense to the client.

And the reason this structure matters is that it means RIA custodians are fundamentally misaligned with the advisors they serve. Because a situation is created where we as RIAs create value for our clients by trying to systematically dismantle the custodian’s revenue and profit lines! Instead of just leaving cash in whatever money market fund is available, we look for ways to reduce cash balances or shift that cash to institutions that best compensate our clients for holding cash. Instead of using an NTF fund with a higher expense ratio, we’ll shift our client’s assets to a non-NTF fund when the ticket charge will reduce costs for them (or vice-versa). And unlike broker-dealers who stand to profit from increased trading (by marking up the ticket charges for themselves), RIAs try to reduce trading costs by helping clients avoid unnecessary trading. In short, the problem is that as RIAs, custodians have put us in the position where we look better by sticking it to the custodian… and the more we manage to ‘play the game’ and dismantle the custodian’s profit centers, the more money we save our clients, and the better we look to our clients!

And this is why the future of the RIA custody business will eventually be RIAs simply paying a basis point custody fee to the RIA custodian instead. Which is a huge leap relative to the “free” that we as RIAs currently enjoy with our custodians… but basis point custodial fees would actually be better for all of us in the long run! Suppose RIA custodians charged 10 basis points, tiering down to 7, 5, and then 3 basis points for large firms (intended to simply approximate what they already make off of RIA clients on average). If custodians did this in lieu of making money off of our clients, now their incentive is not to try and figure out how they can make more money off of our clients, but instead to truly create the best RIA custody platform out there for gathering client assets! With a custody fee in place, RIA custodians could then pay better rates on money market funds, eliminate ticket charges that annoy our clients (and time spent by advisors devising ways around ticket charges for our clients), and eliminate both 12b-1 fees and sub-TA fees, instead providing a new version of truly “clean shares” that strip out all back-end fees (regardless of what fund company is used). In other words, once the RIA custodian gets an RIA custody fee, the custodian is freed up to actually give us as advisors the best possible solutions for our clients!

Of course, there may be some challenges in getting RIAs to adopt such a model, particularly given that a subset of RIAs – namely those that use buy and hold portfolios for clients and actively seek ways to get clients the best deal on cash holdings – are already paying less (as they’re effectively subsidized by the RIAs that do not use such strategies!).

But the bottom line is just to recognize that, in the long-run, both RIAs and the custodial platforms they use would be better off with custodians charging a basis point custody fee, rather than just looking for ways to make money off of our clients. Even though it may feel really awkward to us when we’re not using to paying that custody fee, it will ultimately be better, both for the custodian and for the RIA itself, by properly aligning their interests… which means, in the end, it’s better for the client, too!

source https://www.kitces.com/blog/ria-custodian-basis-point-custody-fee-for-platform-and-better-products/?utm_source=rss&utm_medium=rss&utm_campaign=ria-custodian-basis-point-custody-fee-for-platform-and-better-products

Wednesday, 23 May 2018

GDPR Compliance Rules For Financial Advisors Engaged In Digital Marketing

You may have noticed a wave of Privacy Policy updates coming through your inbox lately. What financial advisors, and particularly those of us in the US, may be less knowledgeable of, is what’s driving these updates. The reality is that the updates are the result of General Data Protection Regulation (GDPR), which is a new set of laws that govern internet privacy in the EU, going into effect May 25, 2018. And while it may seem that privacy regulation in the EU is irrelevant to US advisors, that may not be the case. In fact, if you have any clients in the EU, you market your services to clients in the EU, you have clients who will be moving to the EU, or even if you may merely have EU web traffic, then you could be impacted by GDPR!

In this guest post, Zach McDonald of Mineral Interactive, shares his thoughts on how advisors can remain compliant with EU laws after GDPR goes into effect, including the rights of consumers guaranteed under GDPR (e.g., right to be forgotten, right to have access to personal data, right to grant or deny services consent, and right to grant or deny placement of cookies), the advisors potentially impacted under GDPR (including any advisors who work with clients in the EU, as well as potentially those who may merely have EU web traffic), the steps advisors can take to become GDPR compliant (from getting permission to track cookies, to verifying that vendors are compliant, and more), and the tools advisors commonly use that could also create GDPR issues (such as appointment schedulers, landing pagers, and many others)!

Ultimately, though, the key point is to acknowledge that advisors in the US cannot simply ignore GDPR as something that only applies to those in Europe. Many advisors in the US could fall under GDPR, due to something as minor as a single client who moves to Europe, or even just getting EU web traffic (whether the advisor wants it or not!). Advisors overlook GDPR compliance at their own risk, as failure to comply with GDPR can lead to fines of up to $20M! And given the recent scandals and large-scale breaches of consumer data in the US – such as those at Facebook and Equifax – GDPR could simply serve as a bellwether of changes to come in the US as well!

source https://www.kitces.com/blog/gdpr-compliance-rules-financial-advisors-digital-marketing-data-controller/?utm_source=rss&utm_medium=rss&utm_campaign=gdpr-compliance-rules-financial-advisors-digital-marketing-data-controller

Tuesday, 22 May 2018

Graduating Soon? 5 Financial Tips to Help You Manage Your Money and Taxes

source https://blog.turbotax.intuit.com/tax-deductions-and-credits-2/education/graduating-soon-5-financial-tips-to-help-you-manage-your-money-and-taxes-23223/

#FASuccess Ep 073: Why Successful Advisor Marketing Is More About Staffing Than Spending with Sheri Fitts

Welcome, everyone! Welcome to the 73rd episode of the Financial Advisor Success Podcast!

My guest on today’s podcast is Sheri Fitts. Sheri is the founder of ShoeFitts, a marketing consulting firm for financial advisors, and is the Chief Marketing Officer for Sheridan Road, a Chicago-area advisory firm that works primarily with qualified plans and has nearly $13 billion of assets under management.

What’s unique about Sheri, though, is her particular focus on how to craft “unforgettable” marketing strategies to really differentiate yourself… right down to the fact that, as the founder of ShoeFitts marketing, she gives away colorful socks as a gift. Because it’s unique. And that makes it hard to forget.

In this episode, we talk in depth about how to leverage and maximize marketing ideas, from the importance of trying to craft your own memorable and distinct marketing initiatives, why it’s crucial to align the marketing of the firm with the kind of business you want to grow towards in the future, the importance of systematizing your marketing processes so that you can measure and refine them, and why it’s so important to have a staff member who is formally responsible for marketing in your firm, even if that means 75% of your “marketing costs” are actually staffing costs, and only 25% of the budget actually goes to a traditional spend on marketing itself.

We also talk about Sheri’s own path as a marketing consulting, how she decided to make the leap from a traditional corporate job to going out on her own as an independent consultant because she didn’t want to be buried in managing people, the ironic challenge she faced when her independent consulting firm grew so quickly that she once again found herself in the position of managing people, and how she restructured her firm yet again to allow her to focus her time on the tasks she enjoys the most. Which I think has parallels for most of us as advisors, too.

And be certain to listen to the end, where Sheri provides her own perspective on the fundamental difference between sales and marketing, and why advisory firms need to cultivate both in order to succeed.

So whether you are interested in learning how to craft an unforgettable marketing strategy, what you can do to systematize your marketing process so that it can be measured and refined, or are wondering how you can best structure your firm so that you can focus on the tasks that you want to, I hope you enjoy this episode of the Financial Advisor Success podcast!

source https://www.kitces.com/blog/sheri-fitts-shoefitts-podcast-financial-advisor-marketing-sheridan-road/?utm_source=rss&utm_medium=rss&utm_campaign=sheri-fitts-shoefitts-podcast-financial-advisor-marketing-sheridan-road

Monday, 21 May 2018

How To Profitably Price Fee-For-Service Financial Planning

One considerable challenge for financial advisors providing fee-for-service financial planning services is figuring out the “right” price that is both profitable and attractive to consumers. Notably, this is a challenge that largely did not apply to past generations of advisors, who typically either just sold products with commissions that were determined by product manufacturers, or charged an AUM fee in which there was strong convergence on the 1% price point. As a result, fee-for-service advisors who are aiming to reach clients through a different compensation model – and particularly those prospective clients which cannot be reached through traditional compensation methods – have both an opportunity to expand service into previously unserved markets, but also a challenge in needing to take more responsibility for determining how to do so.

In this guest post, Alan Moore of XY Planning Network and AdvicePay, shares his thoughts on how to profitably price fee-for-service financial planning services, including options for calculating financial planning fees (e.g., flat fee, hourly, project-based, percentage of net worth and income), the structure of paying advice fees (e.g., one-time fees, ongoing fees, or a combination), setting the right advice fee frequency (e.g., monthly, quarterly, semi-annual, annual), how to integrate some combination of fee-for-service and AUM fees, how to make sure your fees are both profitable and reasonable for your niche clientele, and also how to make sure you handle fee-for-service planning fees in a compliant manner!

Ultimately, though, the key point is to acknowledge that like the massive shift from commissions to AUM over the past few decades – which allowed advisors to serve clients in a fundamentally different way and reduced certain conflicts of interest – the opportunity to provide fee-for-service financial planning services allows advisors to continue to evolve their business models, profitably serving an increasing range of clients with fewer conflicts of interest. The fee-for-service model does present new challenges in setting a firm’s fees, but advisors with a fee-for-service financial planning model are poised for success and capable of serving the next generation of clients who are eager to receive real financial advice!

source https://www.kitces.com/blog/pricing-cost-fee-for-service-financial-planning/?utm_source=rss&utm_medium=rss&utm_campaign=pricing-cost-fee-for-service-financial-planning

Friday, 18 May 2018

Weekend Reading for Financial Planners (May 19-20)

Enjoy the current installment of “weekend reading for financial planners” – this week’s edition kicks off with the news that the DoL fiduciary rule still isn’t quite dead yet, with the attorney generals of three states now appealing to the full group of 5th Circuit judges to (re-)consider their request to take up the defense of the DoL fiduciary rule after the Department of Justice declined to defend it themselves, suggesting that it’s inappropriate that the judges who vacated the fiduciary rule itself should also be allowed to determine alone whether the states should be allowed to appeal their ruling.

Also in the news this week were some notable statements from the SEC’s enforcement division that its recent Share Class Selection Disclosure (SCSD) Initiative may be part of a broader enforcement policy shift where the SEC will try to use amnesty programs to encourage more advisory firms to step forward and fix widespread abuses (while the SEC focuses its resources on higher-stakes enforcement issues with less of a “broken-windows” approach to their firm exams), and an interesting survey finding that affluent clients are increasingly looking to their financial advisors to be tax experts (in addition to investment experts).

From there, we have several articles on building relationships with clients and colleagues, including one that explores why most networking meetings are useless (hint: if you really want to build new relationships, you need to engage in an activity with someone you don’t know, not just casual conversation), another looking at the kinds of (often unwitting) behaviors that advisors engage in with prospects that may prevent them from becoming clients, and the issues to consider when trying whether to spend more time socializing with clients outside of a professional setting (or not).

We also have a few retirement-related articles, from a look at why the uncertainties of retirement mean Monte Carlo analysis is especially appropriate to evaluate and craft potential retirement recommendations (because it implicitly explores a very wide range of “What-If” scenarios), to how to handle new retirees who excitedly retire early only to discover that retirement is a “total bore” for them, and a look at how the decisions of where retirees live is starting to reshape how cities develop, as retirees increasingly are not just moving to warmer climates to retire but instead are simply seeking out more distant suburbs and/or lower cost metropolitan areas.

We wrap up with three interesting articles, all around the theme of the financial advisory industry’s struggles with diversity: the first is a look at a recent CFP Board research study on the factors that are limiting racial diversity of financial advisors; the second is a study showing that financial advisors have the worst rate of sexual harassment (as compared to other industries); and the last shows that financial advisors also have the largest gender pay gap of any occupation, even after controlling for advisor productivity and years of experience, suggesting that the profession is still far less of a true meritocracy than is commonly believed… and that for all of these issues, there is a need for a broader change in the culture of financial services, beyond just building better “awareness” and “sensitivity training” programs.

Enjoy the “light” reading!

source https://www.kitces.com/blog/weekend-reading-for-financial-planners-may-19-20-2/?utm_source=rss&utm_medium=rss&utm_campaign=weekend-reading-for-financial-planners-may-19-20-2

Thursday, 17 May 2018

Why The LearnVest Acquisition Is Actually A Success For Northwestern Mutual

Two weeks ago the big industry news was Northwestern Mutual’s announcement that they are terminating their monthly subscription fee financial planning solution, terminating their LearnVest@Work solution, and that the LearnVest brand would be going on a 6-month hiatus, to re-launch later this year as a “fresh, digital resource focused on educating consumers on how to meet their financial goals.” When the news broke, the industry media pounced on this with the message “Northwestern Mutual is shutting LearnVest down”, and immediately began with the “post-mortem autopsy” analyses of what happened and how Northwestern Mutual got to the point that they’re shutting down a business that they bought 3 years ago for a whopping $250 million dollars. However, I think the industry and the media have completely missed the point on this story, and the reality is that Northwestern Mutual’s acquisition has not been a failure, and may in fact still be just getting started!

In this week’s #OfficeHours with @MichaelKitces, my Tuesday 1PM EST broadcast via Periscope, we discuss why Northwestern Mutual’s acquisition of LearnVest has not been a failure, and particularly why the acquisition was never about Alexa Von Tobel’s “$19 per month financial planning service” in the first place, but instead about acquiring a powerful technology tool along with 1.5 million users who are leads that Northwestern Mutual can cross-sell products to!

To better understand what was really going on in the LearnVest deal, it’s important to recognize that there were really three separate assets associated with LearnVest, all under one umbrella… The first was the LearnVest financial planning business, which at the time had about 10,000 “premium” clients paying $19/month for financial planning advice, as well as another 25,000 clients who were workers enrolled in the “LearnVest@Work” financial wellness program that they had just launched. The second asset of LearnVest was their content platform. LearnVest had a content and educational website, targeted primarily at women and younger investors, that had hundreds of thousands of unique monthly visitors, and was supported by the media exposure of their CEO Alexa Von Tobel herself. The third asset of LearnVest was their Personal Financial Management portal, and the financial planning software they built on the back end, which at the time of acquisition reportedly had a whopping 1.5 million registered users.

The reason this matters is that much of the criticism of at the time of Northwestern Mutual’s acquisition was solely focused on the LearnVest’s financial planning business, with commentators asking how a business could be worth 50 to 100 times their revenue while not growing that much. But the reality is that the real value of LearnVest was not their planning business, it was their planning software and the 1.5 million users that Northwestern Mutual could cross-sell their products to. In light of the value of lead generation implied by SmartAsset’s new lead generation service for advisors ($60 to $570 dollars per lead) as well as Fidelity’s purchase of eMoney for $250 million, Northwestern Mutual paid $250 million for planning software with a PFM portal, and a strong consumer brand to bring in prospects, and a list of 1.5 million existing users who could be prospects that alone might have been worth $250 million. Which means, when carefully looking at each of these assets, the market value of that deal might have been closer to half a billion dollars.

And this is why it’s so misguided to suggest that Northwestern Mutual didn’t get, or isn’t going to get, its value out of the LearnVest deal just because the LearnVest planning business is shutting down. Because it wasn’t about the LearnVest business model in the first place, it was about Northwestern Mutual’s business model. Northwestern Mutual’s primary business is manufacturing insurance products. They didn’t buy LearnVest’s content platform and planning software for the LearnVest model. They bought it to power the Northwestern Mutual model. And they can do that by getting 1.5 million leads to whom they could sell Northwestern Mutual products, as well as financial planning and PFM software to make all the Northwestern Mutual agents more efficient and better engaged with their clients (which helps sell more Northwestern Mutual products). In fact, one of the “little noted” details about the news that “Northwestern Mutual was ‘shutting down’ LearnVest” is that the actual staffing of LearnVest in New York City is up, from 150 employees when they were bought, to almost 450 employees now. That’s not an acquisition that’s failing. That’s an acquisition that’s becoming a major part of the entire national Northwestern Mutual enterprise.

The bottom line, though, is just to recognize that the Northwestern Mutual acquisition wasn’t the acquisition of financial planning business. It was a technology acquisition. Insurance agents have always gone the deepest on cash flow planning (granted, to help show them how to “save” $200/month into a permanent life insurance policy), so the deal shouldn’t be viewed as a “failure” because LearnVest Planning didn’t survive. LearnVest’s financial planning wasn’t why Northwestern Mutual bought it in the first place!

source https://www.kitces.com/blog/learnvest-shutting-down-northwestern-mutual-success-financial-planning-software-pfm/?utm_source=rss&utm_medium=rss&utm_campaign=learnvest-shutting-down-northwestern-mutual-success-financial-planning-software-pfm

Wednesday, 16 May 2018

How “Ownership” Of A Client Relationship Influences Financial Advisor Behavior

Economists have long studied the importance of property rights in a wide range of settings. From collectively avoiding circumstances that may lead to an inefficient use of resources (e.g., the “tragedy of the commons”), to simply understanding what conditions best promote the development of a wealthy and prosperous society, property rights are an important economic concept that can be applied in many contexts. Of interest to financial advisors, a recent study by Chris Clifford and William Gerken examined whether and how who “owns” a client relationship in a financial advisory firm – the firm, or the advisor themselves – influences that financial advisor in the future, based on the behavior of financial advisors at firms that joined the Broker Protocol (versus those that did not).

In this guest post, Dr. Derek Tharp – a Kitces.com Researcher, and a recent Ph.D. graduate from the financial planning program at Kansas State University – takes a deep dive into this recent Broker Protocol study, examining how “ownership” of a client relationship in a financial advisory firm impacts not just the success of the firm, but whether and how much the advisor reinvests into themselves, consumer well-being and advisor misconduct rates, and even the development of the advisory industry as a whole!

The development of the Broker Protocol was significant because it, for the first time, formalized exactly what information brokers can (and cannot!) take with them when changing from one firm to another, which not only helped provide a pathway for brokers to change firms without getting sued, but effectively shifted the “ownership rights” of the client relationship from the firm to the advisor (who can now take the information and relationship with them when switching to a new firm). Accordingly, Clifford and Gerkin utilized publicly available data on broker-dealers in conjunction with their timing of joining the Broker Protocol to evaluate how broker behavior changed before and after being given greater ownership over the client relationship. The astounding results: giving a greater level of ownership in the client relationship to the broker resulted in less broker misconduct, more broker investment in their general human capital, and an increase in firm revenue, client assets, and the number of client accounts (even though brokers did invest less into firm-specific human capital along the way).

Notably, the dynamics which led to the creation of Broker Protocol among broker-dealers largely exist within RIAs as well. Restrictive covenants commonly found at RIAs (such as non-solicits, or, less commonly, non-competes), can influence the level of advisor “ownership” over client relationships. Of course, both firms and advisors can have good reasons to accept such agreements (e.g., firms may be hesitant to give inexperienced advisors opportunities to work with clients if they could just “steal” clients without recourse), but it’s important to understand and carefully consider the implications of such arrangements. As ultimately these arrangements impact factors such as the level of advisor talent across the entire industry (as advisors are more inclined to invest in their own human capital when they have greater ownership of cleint relationships), firm success (as a more talented workforce can be a net improvement for firms, even if employee turnover is higher), consumer well-being (as policies which restrict advisor mobility keep talented advisors “trapped” in lower-quality firms, which ultimately leads to lower service for consumers), and even industry regulatory and ethical concerns (as consumers themselves may not be aware that restrictive covenants may influence their abilty to work with their trusted advisor, and consumers may not consent to such arrangements if they were disclosed).

Ultimately, there are steps that firms can take to reduce the harmful elements of restrictive covenants… from adopting an RIA equivalent to Broker Protocol, to regulatory intervention to restrict certain practices, and even pre-arranged terms for buying an advisor’s client base if they wish to a leave a firm… but the key point is to acknowledge that advisor ownership of client relationships does influence advisor behavior in important ways, and that while it may be scary for a firm to vest more ownership in the client relationship to their advisors, the data shows that doing so is on average a benefit to both the advisor and their firm, as well as the consumer, and the industry as a whole!

source https://www.kitces.com/blog/who-owns-client-relationship-property-rights-clifford-gerken-broker-protocol-financial-advisor-firm-study/?utm_source=rss&utm_medium=rss&utm_campaign=who-owns-client-relationship-property-rights-clifford-gerken-broker-protocol-financial-advisor-firm-study

Tuesday, 15 May 2018

#FASuccess Ep 072: The Financial Mechanics Of Buying Into An Advisory Firm And RIA Valuation Trends with David DeVoe

Welcome, everyone! Welcome to the 72nd episode of the Financial Advisor Success Podcast!

My guest on today’s podcast is David DeVoe. Dave is the founder of DeVoe and Company, a practice management consulting firm for RIAs with a focus on business valuations, succession planning, and facilitating mergers and acquisitions of advisory firms.

What’s unique about Dave, though, is the deep history that he has in consulting on and tracking trends in advisory firm mergers and acquisitions, and the valuation of advisory firms, both previously at Charles Schwab where he led Schwab Advisor Services’ Mergers and Acquisitions program, and now as an independent consultant who runs one of the industry’s leading “Deal Book” tracking studies on financial advisor M&A activity.

In this episode, we talk in depth about current trends in the valuation of advisory firms, the flaws in the traditional “2X revenue” valuation estimate for a firm (and why it can actually vary as low as just 1 times revenue or as high as nearly 3X), why focusing on profits and a multiple of free cash flow leads to better valuations than looking at revenue alone, the Growth, Profitability, and Risk factors that impact the valuation multiple for an advisory firm, and how in the end an advisory firm is still, like any business, priced based on the present value of future cash flows, and thus why Dave’s firm takes a discounted cash flow model approach to providing accurate advisory firm valuations.

We also talk about the mechanics of advisory firm deals from the buyer’s perspective, why deals were historically transacted primarily with seller financing, how the rise of third-party bank financing is changing the actual terms and even the valuation of a firm, and why arguably the most important factor in determining the affordability of a purchase is not actually the price of the firm, or the interest rate charged on the note, but the number of years over which the payments are financed that determines whether the buyer has some skin in the game, or if the profits of the firm can actually fully finance the purchase with no ongoing out of pocket cash.

And be certain to listen to the end, where Dave shares his perspective on the buyer and seller trends in the industry, why he sees it as both a “buyer’s market” and a “seller’s market” right now, and why he thinks the greatest risk to valuations is the danger that too many firms try to sell at once… not because there isn’t enough capital to fund all the purchases, but simply because there are still too few buyers for them all to be able to collectively handle the operational challenges of implementing so many mergers and acquisitions at once!

So whether you are interested in learning how to best value your own firm, what you should consider when deciding to purchase into or acquire another firm, or are simply interested in the general market dynamics in a continually evolving market for mergers and acquisitions of advisory firms, I hope you enjoy this episode of the Financial Advisor Success podcast!

source https://www.kitces.com/blog/david-devoe-and-company-podcast-ria-mergers-acquisitions-valuation-investment-banking/?utm_source=rss&utm_medium=rss&utm_campaign=david-devoe-and-company-podcast-ria-mergers-acquisitions-valuation-investment-banking

Monday, 14 May 2018

How to Save for Vacation

source https://blog.turbotax.intuit.com/income-and-investments/how-to-save-for-vacation-19666/

11 Action Steps To Design An Extraordinary Client Experience

As financial advisors, almost all of us strive to deliver a great client service. We may look closely at certain metrics, such as how often we contact our clients, and use that as a guide to how well we are servicing our clients. And while this does provide a certain level of “table stakes” in terms of effectively servicing clients, the reality is that there’s much more to delivering an extraordinary client experience than just great service. Which means, if we truly want to provide an extraordinary service to our clients, we must go beyond just great service and think much deeper about what “client experience” truly is.

In this guest post, Julie Littlechild of Absolute Engagement (a firm that helps advisors craft a client experience that makes them attractive to the right clients) shares her 11 action steps that advisory firms can take to design an extraordinary client experience. Specifically, those steps include segmenting clients, creating a service matrix for the firm to follow, assessing capacity and profitability, defining your niche, co-creating the client experience, mapping out the client journey, creating a client communications plan, structuring the business around an ideal client, defining core processes, creating a client service agreement, and gathering client feedback.

Ultimately, the key point is to acknowledge that what we tend to think of as delivering great service in an advisory business is simply too narrow. We might think of some of the most basic items that are covered in a client service matrix, but it takes a deep dive into all 11 actions in order to truly build an extraordinary client experience. And it’s not necessarily the case that any particular tactic is going make the difference, but instead, the building of a strong foundation that supports a target clientele and is consistent with the client’s journey that truly makes a client’s experience extraordinary!

source https://www.kitces.com/blog/extraordinary-advisor-client-experience-11-action-steps-julie-littlechild-absolute-engagement-workbook/?utm_source=rss&utm_medium=rss&utm_campaign=extraordinary-advisor-client-experience-11-action-steps-julie-littlechild-absolute-engagement-workbook

Saturday, 12 May 2018

5 Tax Tips for Starting a New Business

source https://blog.turbotax.intuit.com/income-and-investments/business-income/5-tax-tips-for-starting-a-new-business-23563/

Friday, 11 May 2018

Weekend Reading for Financial Planners (May 12-13)

Enjoy the current installment of “weekend reading for financial planners” – this week’s edition kicks off with the interesting announcement that SEC Commissioner Piwowar will be retiring in early July, a month before the public comment period closes for the new SEC advice rule, and raising the question of whether the SEC may end out deadlocked by the time the comments are in and it’s actually time to deliberate on a final version of the proposed rule!

Also in the news this week was the announcement that Connecticut has passed a law that would allow its municipalities to create charitable entities to fund public services as a way to work around the new cap on the State And Local Tax deduction (and raising the question of when/whether the IRS and Treasury will challenge the strategy, and if it will ultimately end out in front of the Supreme Court), and the news that a new requirement for bond markup and markdown disclosures will take effect next week, in a move that could put new pressure on size of those trading commissions (or not, since the new disclosures only have to be communicated view printed transaction confirmations that not all investors read anyway!).

From there, we have several articles on industry shifts in advisory fees, including a fascinating overview of the various new advisory fee models that are emerging beyond (just) AUM, to the fact that a segment of financial advisors not only aren’t experiencing fee compression but are actually raising their fees, and advice for firms that are struggling with fee pressures about what to do next (hint: it’s all about giving deeper advice and differentiating beyond increasingly commoditized portfolio solutions alone).

We also have a few practice management articles, from tips about how smaller and solo advisory firms can (legitimately) make themselves look more credible in the eyes of prospects, to the benefits of trying to write a book as a financial advisor, and the value of engaging in PR strategies by doing media interviews to expand the visibility and presence of the advisory firm.

We wrap up with three interesting articles, all around the theme of advisor introspection and overcoming challenges: the first is a look back by an advisor who launched her own solo advisory firm 2 years ago, about what it really took to succeed (hint: it’s more about the ability to adapt to challenges than to predict them in advance, and don’t underestimate the importance and value of having a support community around you!); the second provides some tips to pass the CFP exam from someone who unfortunately failed her first attempt (in part by possibly over-focusing on her weak areas, and unwittingly scoring low in an area she thought was her natural strength!); and the last is a good reminder that if we as financial advisors really believe the primary value of advice is not just the information and expertise, but the benefit of having an objective third-party advisor who can view the situation with emotional detachment… that arguably most of us as financial advisors should have our own advisors too (because it’s not just about the informational expertise we already have!), with the added benefit that if you really want perspective on how to improve your financial planning process with clients, you should try going through the process yourself, too!

And be certain to check out the video at the end – a fascinating look at how Will Smith’s journey into becoming the “Fresh Prince of Bel Air” was driven by the failure to hire a financial advisor and make responsible financial and tax planning decisions after his first album went triple platinum, leading him to seek out new job opportunities because he was broke!

Enjoy the “light” reading!

source https://www.kitces.com/blog/weekend-reading-for-financial-planners-may-12-13/?utm_source=rss&utm_medium=rss&utm_campaign=weekend-reading-for-financial-planners-may-12-13

Why It Can Pay Off to Only Have One Credit Card

source https://blog.turbotax.intuit.com/income-and-investments/why-it-can-pay-off-to-only-have-one-credit-card-40813/

Five Tips to Enjoy and Save This Mother’s Day

source https://blog.turbotax.intuit.com/income-and-investments/five-tips-to-enjoy-and-save-this-mothers-day-19718/

May Newsletter – New Battersea Branch, Easy CIS Tax Refunds, Avoid £10 Daily Fines & More

Our informative May e-Newsletter is now ready to view online. It includes exciting news of our new branch opening in Battersea along with important tax and accountancy-related news that might affect you. Here is a quick summary of the newsletter's contents:

Our informative May e-Newsletter is now ready to view online. It includes exciting news of our new branch opening in Battersea along with important tax and accountancy-related news that might affect you. Here is a quick summary of the newsletter's contents:

- The first article announces the opening of our new Battersea Branch in London SW8. New and existing customers are welcome to pop in and say hello and to get expert help with your tax affairs and accountancy requirements. Learn more about the opening of the Battersea branch, and the core services on offer, here or click the big button below to read the newsletter.

- If you work on one of the many Battersea construction sites in or around SW8, we can help you reclaim overpaid tax and much more ... see the newsletter for more details - click the big button below.

- If you're a sub-contractor working in the construction industry scheme ('CIS'), you're almost certainly due a tax refund (learn why here). Taxfile are experts at getting tax rebates from HMRC, so come and see us and we'll get you the maximum refund possible. Read the newsletter (click the big button below) to learn how we make your tax refund application fast and hassle-free.

- We can help limited company contractors too! We're tax and accountancy experts so we can help you register as a limited company or register for CIS if you're not already set up, we'll help you with the monthly tasks demanded of you by HMRC including accounts preparation, confirmation statements, corporation tax handling, CIS set-off rebate, National Insurance (NI), VAT, bookkeeping, payroll and much more. We'll save you time and will make operating the Construction Industry Scheme a breeze. Click the the newsletter button below for more details.

- If you introduce a family member, friend or colleague to Taxfile, you will get a discount off your next tax return if they sign up as a new paying customer with us. Click the button for details.

- Taxfile recently printed some brightly coloured postcards to promote our new Battersea office and our tax-related services. Simply get in contact if you'd like some of these postcards to hand out to colleagues. If you write your full name on the back and use it to refer a colleague, it might even save you money! Click the button for more details.

- Our team are multi-lingual and always happy to help. If English is not your first language, let us know and we'll try to match you to the most appropriate staff member.

- If you, your friends, family or colleagues have not dealt with your old tax returns, HMRC will be adding £10 per day to the penalty from 1st May. That's on top of the £100 fine that will have applied immediately after missing the original 31 January deadline. Let Taxfile get your tax records, tax returns and overdue tax all in order so you don't have to pay any more in fines than you have already. Learn more here or contact your nearest branch for a consultation.

- All Taxfile clients get free 'Tax Enquiry Fee Protection Insurance' when they file their tax return through Taxfile by the statutory deadline. So - if you're investigated by HMRC - our fees to sort it out are covered. Click the button for more details.

source https://www.taxfile.co.uk/2018/05/may-2018-newsletter/

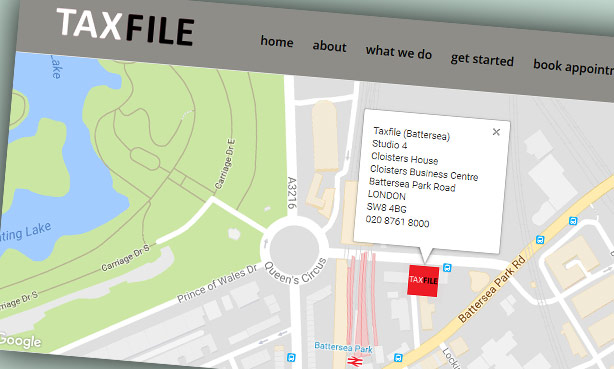

New Battersea Branch – Now Open in London SW8!

Our new branch is now open in Battersea, London SW8. You'll find it very convenient if you work nearby — we're at Cloisters Business Centre, near Battersea Park Station, just off Battersea Park Road (A3205). You can park easily too - just pull into the business centre and you'll find us opposite the church, on the ground floor with the brown door (unit 4). Come and see us there too if you're an existing client and find Battersea more convenient than our Tulse Hill and Dulwich Village offices. During April & May, the Battersea branch is open from 11am right through to 7pm from Monday to Thursday — so you don't need to take a day off work to come and see us. On Fridays we're open 11am to 3pm by appointment and Faiz will be a familiar face to many that day. The new Battersea branch will particularly suit construction workers in the building industry, which is very active in this location. Contractors who have set up as limited companies will find our CIS work, payroll and bookkeeping services particularly useful. Meanwhile, sub-contractors will like the fact that we're experts at getting workers tax refunds and rebates, particularly if they've been working within the Construction Industry Scheme ('CIS'). We claim thousands back from HMRC on their behalf every year. Call 020 7821 9444 for a free 20 minute consultation at the Battersea branch, or 020 8761 8000 for Tulse Hill, Dulwich and all other branches. Taxfile's Battersea branch is at Studio 4, Cloisters House, Cloisters Business Centre, Battersea Park Road, London SW8 4BG. Opening hours: Mon-Thurs 11am-7pm (& Fridays 11am-3pm by appointment). Visit our new, stand-alone Battersea branch website for more details.

Our new branch is now open in Battersea, London SW8. You'll find it very convenient if you work nearby — we're at Cloisters Business Centre, near Battersea Park Station, just off Battersea Park Road (A3205). You can park easily too - just pull into the business centre and you'll find us opposite the church, on the ground floor with the brown door (unit 4). Come and see us there too if you're an existing client and find Battersea more convenient than our Tulse Hill and Dulwich Village offices. During April & May, the Battersea branch is open from 11am right through to 7pm from Monday to Thursday — so you don't need to take a day off work to come and see us. On Fridays we're open 11am to 3pm by appointment and Faiz will be a familiar face to many that day. The new Battersea branch will particularly suit construction workers in the building industry, which is very active in this location. Contractors who have set up as limited companies will find our CIS work, payroll and bookkeeping services particularly useful. Meanwhile, sub-contractors will like the fact that we're experts at getting workers tax refunds and rebates, particularly if they've been working within the Construction Industry Scheme ('CIS'). We claim thousands back from HMRC on their behalf every year. Call 020 7821 9444 for a free 20 minute consultation at the Battersea branch, or 020 8761 8000 for Tulse Hill, Dulwich and all other branches. Taxfile's Battersea branch is at Studio 4, Cloisters House, Cloisters Business Centre, Battersea Park Road, London SW8 4BG. Opening hours: Mon-Thurs 11am-7pm (& Fridays 11am-3pm by appointment). Visit our new, stand-alone Battersea branch website for more details.source https://www.taxfile.co.uk/2018/05/new-battersea-branch-sw8/

Thursday, 10 May 2018

The Advisory Firm Jobs That Robots Really Do Threaten

The early fear around “robo-advisors” was that technology could replace what human financial advisors do, at a fraction of the cost, and that their low-cost solution would attract consumers in a competitive marketplace. Yet in practice, robo-advisors have failed to capture even 0.1% market share of consumer investable assets, in what appears to be more of a niche solution for a subset of tech-savvy self-directed investors, than a mainstream competitor. Nonetheless, the failure of robo-advisors to disrupt human advisors doesn’t mean that the broader the rise of technology won’t reshape the nature of our advisory firms. Because while our jobs as financial advisors aren’t necessarily threatened by technology, there are other jobs in advisory firms that are increasingly being threatened by technology.

In this week’s #OfficeHours with @MichaelKitces, my Tuesday 1PM EST broadcast via Periscope, we explore the changing nature of advisory industry jobs due to technology, and specifically why it is the back office (i.e., non-client facing) jobs that really are threatened by emerging “robo” and other advisor technology!

The key distinction is that there are really multiple types of jobs in advisory firms, which broader fall into two categories: “front office” jobs, and “back office” jobs. Front office jobs in advisory firms are the client-facing jobs (e.g., advisors themselves, as well as front-of-office staff like a receptionist). Back office jobs, by contrast, are… the ones that are not front office (i.e., not client facing) – the operations and administrative jobs in the firm (e.g., portfolio trading, account opening, transfers, insurance and annuity applications, etc.). Some people will add in a third category as well, called the “middle office”, which are the jobs that hold the firm together as a business (e.g., executives, managers, researchers, compliance & oversight). The fundamental point, though, remains simply that there’s a range of “advisory firm jobs”, from the front office client-facing stuff, to the back-office administrative and operations jobs, and the middle office jobs that hold it all together.

The reason this matters is that the real threat of robo-advisors (or technology more generally), is not to front-office advisor jobs, but towards the back office and more administrative jobs. Because while back office jobs are absolutely crucial – they’re the actual “doing” jobs that get key tasks done, repeatedly, day after day and week after week, client by client… it’s the very fact that they’re often repetitive tasks that make them prone to being replaced by technology. Consider the process of actually implementing a portfolio… At one point in time, this was a highly manual process (manually type holdings into a spreadsheet, pull up fund reports, do some research on alternatives, calculate tax implications, manually type in all trades, etc.), but with modern rebalancing software, one trader can handle this process for a thousand clients simultaneously in just an hour or two. Which means, for a sizable advisory firm, the clients of a dozen advisors might have historically required a dozen staff members just to do the trading… and now it’s just one person with some software to get it done. And as technology continues to march on (in ever-new categories like robo-onboarding, online scheduling, etc.), back office jobs will increasingly be at risk. Ultimately, this is good for advisory firms, are it allows the firm and its advisors to focus more on working with clients and less on administrative tasks. But it is a threat to those back office jobs.

Which means it’s important for people currently working in back office roles in advisory firms to think about what this means for them in the long run, and which of two paths they want to pursue next. The first option is to try and move up on the administrative side of the organization, shifting from more a back office oriented position to a middle office position. The caveat to this approach is that not everyone in an organization will ultimately be able to make this transition, as there are more admin jobs than manager jobs (e.g., 6 staff reporting to 1 manager means only one can move up!). The second option is to try and move into a front office role (i.e., go down the road of becoming an advisor), starting by enrolling in a program like the College for Financial Planning’s old “Registered Paraplanner” program (now rebranded as the “Financial Paraplanner Qualified Professional” (FPFQ) program), with the ultimate plan of pursuing CFP marks as well.

The bottom line, though, is to recognize that the rise of technology isn’t a threat to financial advisors, because the technology doesn’t do what financial advisors do. But the operational efficiencies technology can create will begin to threaten the back office administrative jobs that complete those tasks today… which may ultimately make the firm more efficient, but means it’s important for those currently in such jobs to reinvest into themselves to thrive in the future!

source https://www.kitces.com/blog/back-office-jobs-threatened-by-robo-advisors-not-front-office-financial-advisors/?utm_source=rss&utm_medium=rss&utm_campaign=back-office-jobs-threatened-by-robo-advisors-not-front-office-financial-advisors

Wednesday, 9 May 2018

How I Spent Less and Increased My Refund This Tax Season

source https://blog.turbotax.intuit.com/tax-planning-2/how-i-spent-less-and-increased-my-refund-this-tax-season-40802/

Proactive Section 199A Deduction Strategies For Small Business Owners

The Tax Cuts and Jobs Act brought the biggest changes to both individual and corporate taxes that we’ve seen in the past 30 years. Included in those changes was IRC Section 199A, which is a new section of the tax code that introduces a 20% deduction on qualified business income (QBI) for the owners of various pass-through business entities (which include S corporations, limited liability companies, partnerships, and sole proprietorships). Fortunately, the QBI deduction will provide big tax breaks for many business-owning clients, but unfortunately, the new deduction is highly complicated, and it may take some time before the IRS can even provide more meaningful guidance on how it will be applied. However, the reality is that the planning opportunities created by IRC Section 199A are tremendous, and practitioners are already eagerly exploring how they can help clients reduce their tax burden through creative strategies around the QBI deduction.

In this guest post, Jeffrey Levine of BluePrint Wealth Alliance shares some of his own QBI deduction strategies and considerations after the TCJA. Broadly speaking, most strategies QBI deduction strategies can be the three buckets of QBI deduction strategies, including income reduction strategies to stay below the income threshold where the specified service business or wage-and-property tests kick in, “income alchemy” strategies for transforming income from a specified service business into non-specified service business income, and other business strategies – such as hiring more W-2 employees – which are focused on favorably characterizing business income.

Notably, within each bucket are a wide range of planning strategies. Business owners who could benefit from business reduction strategies can consider ideas such as planning around retirement contributions, transferring portions of ownership to various non-grantor trusts, and revisiting filing separately as a married couple. Business owners who could benefit from “income alchemy” strategies can consider spinning-off certain assets and leasing them back, creating employee leasing companies, and even avoiding marketing language that makes strong claims about a business owner’s skill. And business owners who could benefit from favorably characterizing business income may want to reduce or eliminate guaranteed payments to partners, change profit-eligible-only S corporations to partnerships, or switch from a salaried employee to an independent contractor.

Ultimately, the key point is to acknowledge that IRC Section 199A creates a tremendous number of planning opportunities after the TCJA. New strategies with QBI deduction implications will certainly continue to be developed with time and further guidance from the IRS, but even in the present, financial planners already have enough reason to reach out to business-owning clients and help them reduce their tax liabilities!

source https://www.kitces.com/blog/small-business-owner-section-199a-qualified-business-income-qbi-deduction-strategies/?utm_source=rss&utm_medium=rss&utm_campaign=small-business-owner-section-199a-qualified-business-income-qbi-deduction-strategies

Happy National Teacher Day! Five Tax Tips to Educate You on Tax Savings

source https://blog.turbotax.intuit.com/tax-deductions-and-credits-2/happy-national-teacher-day-five-tax-tips-to-educate-you-on-tax-savings-19714/

Tuesday, 8 May 2018

How to Save While Planning Your Wedding

source https://blog.turbotax.intuit.com/income-and-investments/how-to-save-while-planning-your-wedding-23264/

Summer Cleaning Donations

source https://blog.turbotax.intuit.com/tax-deductions-and-credits-2/summer-cleaning-donations-3382/

W-4 Withholding and Tax Reform

source https://blog.turbotax.intuit.com/tax-reform/w-4-withholding-and-tax-reform-33053/

#FASuccess Ep 071: Appointing A Chief Planning Officer To Ensure Firm-Wide Consistency In Financial Planning Advice with Peggy Ruhlin

Welcome, everyone! Welcome to the 71st episode of the Financial Advisor Success Podcast!

My guest on today’s podcast is Peggy Ruhlin. Peggy is a partner and the CEO of Budros, Ruhlin, and Roe, a wealth management firm in Columbus, Ohio that oversees nearly $2.5 billion of assets under management for nearly 700 affluent clients.

What’s unique about Peggy and her firm, though, is the way that they have focused on systematizing the financial planning recommendations they make within the firm, to ensure that every client in the firm truly receives consistent advice and a consistent planning experience across the firm’s five planning teams.

In this episode, we discuss in depth the firm’s approach to making their financial planning more consistent, including regular “collaborative studies” meetings one Monday a month, peer-to-peer presentations on a quarterly basis to review unique planning cases, a bi-weekly financial planning committee meeting to discuss what the firm’s standard recommendations will be on various planning issues, creating a “Wealth Management Resource” library to catalog them, and appointing a “Chief Planning Officer” to be responsible for it all, just as the firm has a Chief Investment Officer to do the same in standardizing the firm’s investment process!

We also talk about the evolution of how Budros, Ruhlin, and Roe has done business with clients over the past 30 years that Peggy has been there, from starting out as a financial-planning-only firm back in the 1980s (when it was not very common to do so!), the combination of net worth and income fees they used in their early years, why the firm ultimately shifted to add in investment management services and adopt the AUM model, and how they currently offer clients a choice between investment management only for a percentage of assets under management, or a comprehensive wealth management relationship for a percentage of their total net worth under advisement.

And be certain to listen to the end, where Peggy shares her own career path, from starting out as a CPA who decided to earn her CFP marks to make a shift from historically-focused accounting and tax compliance to forward-looking financial planning, why she’s been an active volunteer over the years with organizations from the IAFP to the Foundation for Financial Planning and now the CFP Board’s Board of Directors, and why she says that volunteering in professional organizations in her early years was more instrumental than anything else she did to advance her own career!

So whether you are interested in learning how a Chief Planning Officer can help ensure firm-wide consistency in financial planning, why a firm which set out to be financial planning only added in investment management services as well, or how volunteering in professional organizations can advance your career, I hope you enjoy this episode of the Financial Advisor Success podcast!

source https://www.kitces.com/blog/peggy-ruhlin-budros-roe-podcast-chief-planning-officer-iafp-fpa-cfp-board-volunteer/?utm_source=rss&utm_medium=rss&utm_campaign=peggy-ruhlin-budros-roe-podcast-chief-planning-officer-iafp-fpa-cfp-board-volunteer

Monday, 7 May 2018

Four Ways to Make Your Tax Refund Deductible Next Tax Season

source https://blog.turbotax.intuit.com/tax-refunds/four-ways-to-make-your-tax-refund-deductible-next-tax-season-40764/

Is This Tax Deductible? My Child’s Summer Camp

source https://blog.turbotax.intuit.com/tax-deductions-and-credits-2/family/is-this-deductible-my-childs-summer-camp-19801/

The Latest In Financial Advisor #FinTech (May 2018)

Welcome to the May 2018 issue of the Latest News in Financial Advisor #FinTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors and wealth management!

This month’s edition kicks off with the big news that private equity firm Hellman & Friedman is purchasing Financial Engines for a whopping $3 billion in cash, and intends to pair what many call the “original robo-advisor” together with (also-Hellman-owned) Edelman Financial, in an effort to expand Financial Engines’ services to 401(k) plan participants to include human comprehensive financial planners. Which is notable both that major investors now see the upside of “robo” platforms as expanding them back into human advisors, and also because if it works it could dramatically alter the landscape for 401(k) rollovers by making those assets “advised” by a comprehensive financial planner before they ever become a rollover opportunity in the first place!

From there, the latest highlights also include a number of interesting advisor technology announcements, including:

- Personal Capital pairs up with Alight to distribute its PFM solution into the large firm employee channel as a means of getting financial advice prospects

- Goldman Sachs buys the Clarity Money PFM solution as a way to cross-sell its Marcus bank products to nearly 1 million Clarity users

- “Free” robo-advisor WiseBanyan raises $6.6M of venture capital to cross-sell more a-la-carte “premium” services to its existing 32,000 clients

- Australian Salesforce CRM overlay PractiFI partners with Black Diamond to bring its “business management” advisor CRM solution to the U.S.

- Chalice Wealth Partners launches a new “technology network” that aims to charge advisors $249/month to integrate their technology (overlaid onto Chalice’s B/D-RIA platform).

Read the analysis about these announcements, and a discussion of more trends in advisor technology, in this month’s column, including United Capital’s shift into providing a standalone FinLife Partners option (dubbed FinLife CX) for firms that want to continue using their existing CRM software, the launch of a “RoboWholesaler” that aims not to fully replace human wholesalers but make it easier for financial advisors to control the process by identifying the funds they’re interested in and then contacting the wholesalers they want to talk to, the rollout of a straight-thru insurance application process by Cetera that is integrated directly into MoneyGuidePro financial planning software, a look at whether the new ScratchWorks competition could be a new model for Advisor FinTech startups aiming to raise capital, and the opening of the application period for the third annual XYPN FinTech Competition for advisor fintech startups specifically aiming to support financial advisors serving next generation (i.e., Gen X and Gen Y) clientele.

And be certain to read to the end, where we have provided an update to our popular new “Financial Advisor FinTech Solutions Map”, including a number of new companies and categories!

I hope you’re continuing to find this new column on financial advisor technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to TechNews@kitces.com!

source https://www.kitces.com/blog/the-latest-in-financial-advisor-fintech-may-2018/?utm_source=rss&utm_medium=rss&utm_campaign=the-latest-in-financial-advisor-fintech-may-2018

Friday, 4 May 2018

Weekend Reading for Financial Planners (May 5-6)

Enjoy the current installment of “weekend reading for financial planners” – this week’s edition kicks off with the news that the 5th Circuit Court of Appeals declined the motion by AARP (and several state attorney generals) to intervene in an effort to defend the DoL fiduciary rule… which means unless the Department of Justice suddenly (and at this point, unexpectedly) petitions the Supreme Court to hear the matter, it appears the DoL fiduciary rule will officially be vacated and gone and dead for good next week on May 7th (even as debate about the SEC’s advice rule is just starting to gain momentum).

Also in the news this week was the announcement of a blockbuster private equity deal that will merge together Financial Engines and mega-RIA Edelman Financial (bringing human financial advisors to the 401(k) channel in a manner that could make it more challenging for independent advisors to access 401(k) rollovers in the future), and an interesting study that finds the average financial advisor is significantly more stresses than most U.S. workers, mostly about compliance and regulation and the difficulty in growing an advisory firm in today’s environment… even as the majority of advisors still report they are overall very satisfied with their careers.

From there, we have several articles on marketing, including a look at how much less advisory firms spend on marketing compared to most industries (and where/how they should deploy the money if they do decide to start spending), a reverse-engineered analysis of how mega-RIA Fisher Investments spends its online marketing dollars for advertising and more traffic to its websites, and why the best way to connect with prospects is still about telling your own personal story and why it is that you chose to become a financial advisor in the first place.

We also have a few practice management articles, from a discussion of why it’s a good idea for every advisor to take a week to track their time (and better understand how they’re splitting their time between client service, growth, and administrative tasks) to understand what they might want to change to improve their personal productivity (and happiness), to an exploration of how to set the right “foundation” for providing a good experience to clients, and why it’s better to not just be an expert for your clients but their counselor (or trusted “consigliere” instead).

We wrap up with three interesting articles, all around the theme of using credit cards instead of cash and the rise of travel rewards cards: the first is a review of the biggest and most popular standalone travel rewards cards (including American Express, Chase, and Citi); the second looks at how travel rewards cards have remained remarkably durable and popular over the span of more than 30 years now, but how their benefits are shifting away from increasingly devalued points and towards various “perks” instead, and how the rise of both credit and debit cards, online purchases, and systems like Apple Pay are making it increasingly easy to go “cashless” altogether… at least, as long as you don’t need to tip your local service provider!

Enjoy the “light” reading, and Happy Star Wars Day!

source https://www.kitces.com/blog/weekend-reading-for-financial-planners-may-5-6/?utm_source=rss&utm_medium=rss&utm_campaign=weekend-reading-for-financial-planners-may-5-6

May the Fourth (and These Spring Savings Tips) Be with You!

source https://blog.turbotax.intuit.com/income-and-investments/may-the-fourth-and-these-spring-savings-tips-be-with-you-19688/

5 Ways to Save This Cinco De Mayo

source https://blog.turbotax.intuit.com/income-and-investments/5-ways-to-save-this-cinco-de-mayo-22980/

Thursday, 3 May 2018

Why The Financial Engines/Edelman Financial Deal Could End The 401(k) Rollover Bonanza

The blockbuster announcement in the RIA space this week was that private equity firm Hellman & Friedman is buying Financial Engines and taking it private for a whopping $3 billion dollars in cash, and in the process will be merging it with mega-RIA Edelman Financial – of which Hellman already owns a majority stake from a purchase back in 2015 – to make a new combined entity of both Financial Engines and Edelman Financial. Which is a mega deal not just because Financial Engines got bought for $3 billion dollars (and has an estimated $169 billion of assets under management in the managed 401(k) space) but also because Edelman Financial itself has $21 billion under management and is one of the largest independent RIAs in the country with almost 35,000 clients of their own for whom they do investment management and financial planning, with more than 100 (human) financial advisors.

In this week’s #OfficeHours with @MichaelKitces, my Tuesday 1PM EST broadcast via Periscope, we explore the implications of this massive deal to pair together managed 401(k) accounts with human financial planners (at a size and scale that few others besides perhaps Fidelity have ever even attempted), and particularly how this may be the beginning of the end of advisors growing their businesses through 401(k) rollovers!